Trading recommendations

Sell Stop 1.0960. Stop-Loss 1.1010. Targets 1.0975, 1.0915, 1.0825, 1.0710

Buy Stop 1.1020. Stop-Loss 1.0960. Targets 1.1045, 1.1120, 1.1185, 1.1205

Technical analysis

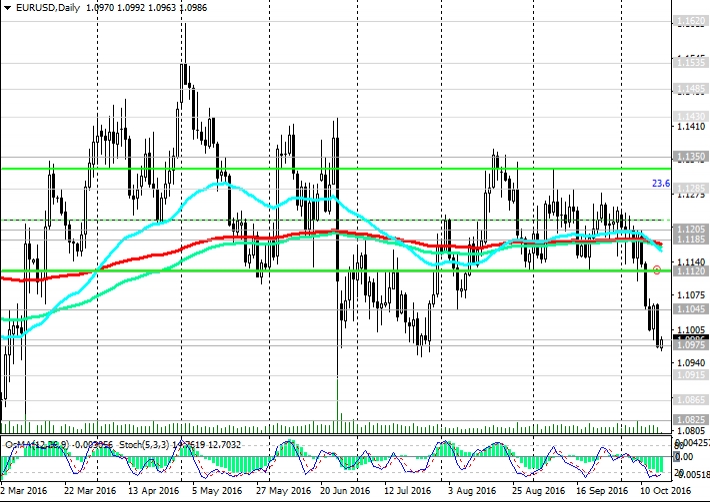

Today the EUR/USD corrected after the decline on Friday. In the course of the sharp decline in the pair broke important support levels 1.1185 (EMA200, EMA144 on the daily chart), 1.1120 (the lower bound of the range between the levels of 1.1285 (Fibonacci 23.6% retracement level of the last wave decline from 2014 highs last week of the year), and 1.1120 ( the low of September)). Also at the level of 1.1045 breached the lower boundary of another wider range between the levels of 1.1045 (Aug lows), 1.1350 (August highs). The EUR/USD has found support at 1.0975 (July low), however, it continues to be under pressure. Indicators OsMA and Stochastic on the daily, weekly charts are on seller’s side, on the monthly chart indicators also deployed on short positions.

However, the 1-hour and 4-hour chart indicators turned on long positions, indicating a possible correction to 1.1045. On the weekly chart the pair is reduced in the downlink with the lower boundary, passing below the level of 1.0710 (at least one year). The script on the growth of the EUR/USD suggests a return to the ranges above the levels 1.1045, 1.1120. However, a more likely scenario is for further reduction pair. Different directions of monetary policy of the Fed and the ECB will put pressure on the EUR/USD pair in the medium term and, most likely, until the end of the year, when the Fed meeting will be held in December.

Support levels: 1.0975, 1.0915, 1.0825, 1.0710

Resistance levels: 1.1045, 1.1120, 1.1185, 1.1205, 1.1285

Overview and Dynamics

Financial markets are awaiting the imminent interest rate increase in the United States. According to the analysis on the interest rate futures on the CME, on Friday in the United States the likelihood of a rate hike in December was estimated at 69% and the December gold futures on the COMEX closed on Friday with another decrease (0.2% 1255.50 dollars per ounce) . the WSJ dollar index, which reflects the value of the US dollar against a basket of 16 currencies, rose 0.1% to 88.52, and close to 7-month high. Left on Friday strong data on retail sales in the United States also supported the expectations of Fed interest rates. As stated on Friday, Fed Chairman Janet Yellen, "hysteresis can cause Fed officials to act quickly and aggressively." As noted by other Fed officials Dudley, the Fed to raise rates "very soon." Last week the EUR/USD dropped significantly, losing 210 points, which is about 21%. Today steam is adjusted, however, the pressure on the euro maintained. This week the attention of the financial markets will focus on breaded Thursday meeting of the ECB.

The current program of asset purchases by the ECB of 80 billion euros per year (88 billion US dollars), and ECB President Mario Draghi on Thursday could announce the program changes, which should be completed in March 2017. Expectations of such a decision by the ECB are putting pressure on the euro. From the news today forward the data from the Eurozone. At 09:00 (GMT) will be published index of consumer prices in the euro area in September. Consumer Price Index - a key measure of inflation. The lower the index, the greater the likelihood of further lowering rates in the euro area, and the stronger euro will decline. Publication of the index will cause a surge in volatility at a deviation from the forecast (0.4%) in Euro Commerce and European stocks.

At 17:35 scheduled speech by ECB President Mario Draghi, also give additional volatility in EUR/USD and global stock indices.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI