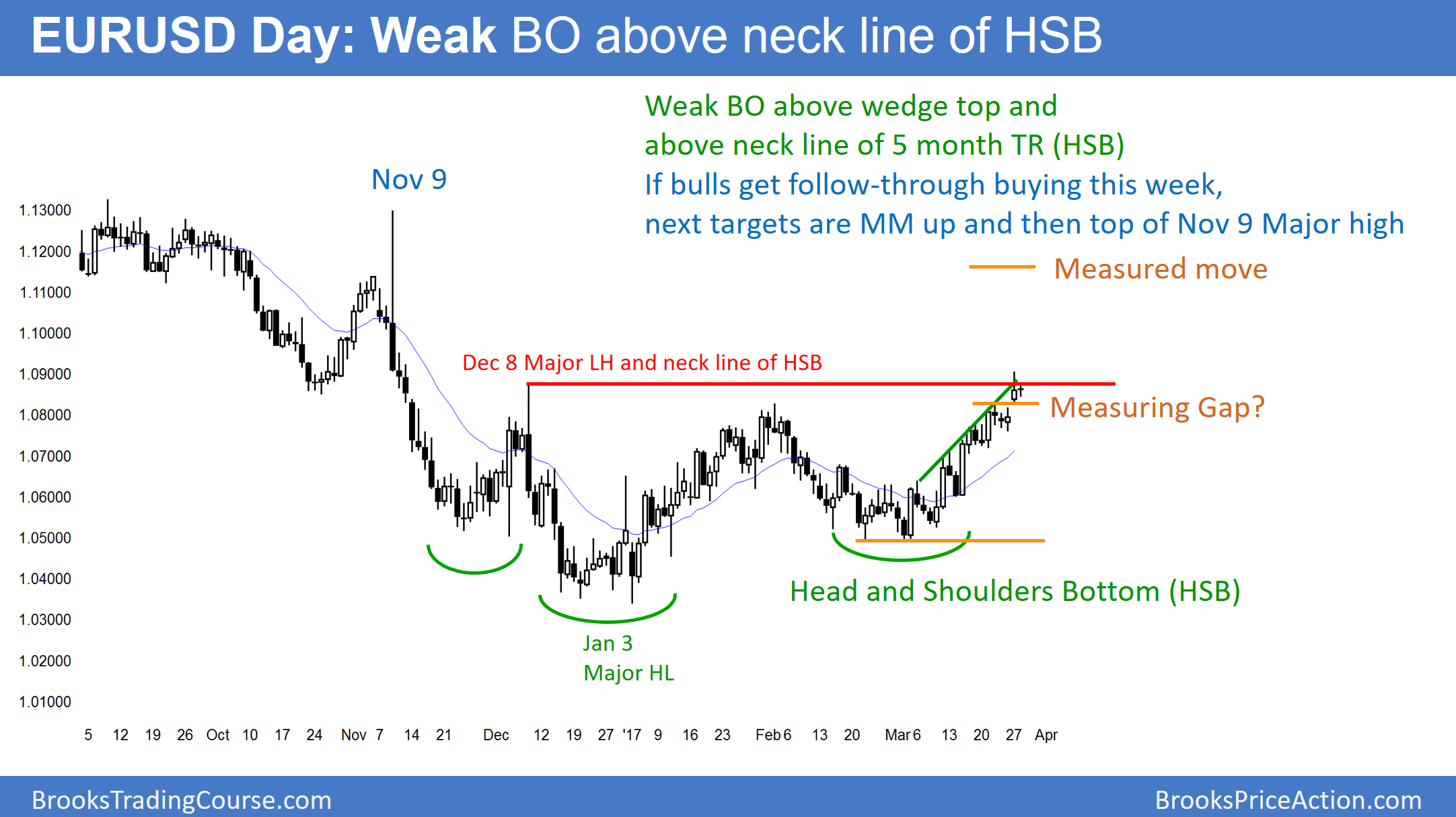

While the EUR/USD daily chart yesterday broke above the top of the 5-month trading range, it closed below the top. This is therefore not yet a strong breakout.

The EUR/USD Forex market has been in a trading range for 5 months. Since most trading range breakouts fail, the odds are that the current one will as well. Yet, there is no top. Hence, the EUR/USD Forex market is deciding whether this breakout will succeed or tail. The bulls need a one or more big bull trend bars closing on their highs. In addition, they need at least a couple closes above the December 8 neck line of the head and shoulders bottom. Without that, the breakout will simply be a probe above the resistance at the top of the trading range.

Because the 5-week rally has been in a tight channel, the bears will probably need at least a micro double top. Traders would like to see a couple breakout attempts fail before they will bet that the breakout will fail. Hence, bulls will probably buy the 1st reversal down. They will therefore probably try to get a strong breakout at least one more time.

Wedge On 240-Minute: Series Of Buy Climaxes

The rally on the 240-minute chart has a series of buy climaxes. Since that is exhaustive price action, it increases the chances of at least a pause or a pullback before the bulls will try again. Yet, when there is a wedge bull channel like this, the bulls still have a 25% chance of a strong breakout above the channel. But, that means that there is a 75% chance of a bear breakout below the channel. That breakout can come from the EUR/USD simply going sideways instead of down. That is what is likely over the next several days.

Overnight EUR/USD Trading

The EUR/USD Forex market has been in a 20-pip range for the past 5 hours. In addition, the range is just below the top of the 5-month trading range. Furthermore, it is at the top of a wedge channel. Therefore, the odds are that it will go mostly sideways for another day or two. Because it is testing the top of a trading range, there is an increased chance of a trend up or down. Yet, as I wrote above, there is enough bull strength to make a big reversal down unlikely for at least a few days. In addition, the bulls have a buy climax. They therefore are probably exhausted and will likely need a day or two before they will try to breakout again.