Trump sends out tariff letters, extends levy deadline - what’s moving markets

Trading the News: Federal Open Market Committee (FOMC) Interest Rate Decision

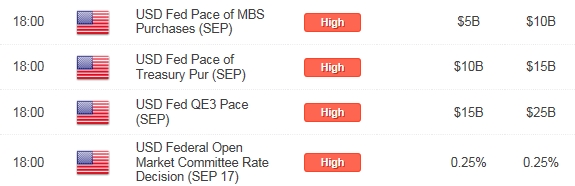

The Federal Open Market Committee (FOMC) interest rate decision may spur a bearish reaction in the dollar (bullish EUR/USD) if the central bank remains reluctant to move away from the zero-interest rate policy (ZIRP).

What’s Expected:

Why Is This Event Important:Even though the Fed is widely expected to conclude its asset-purchase program at the October 29 meeting, we would need a more hawkish twist to the forward-guidance for monetary policy to favor further USD strength.

Expectations: Bearish Argument/Scenario

|

Release |

Expected |

Actual |

|

Non-Farm Payrolls (AUG) |

230K |

142K |

|

New Home Sales (MoM) (JUN) |

-5.8% |

-8.1% |

|

Housing Starts (MoM) (JUN) |

1.9% |

-9.3% |

The dollar may come under pressure should we get more of the same from the Fed, and the greenback may face a larger correction over the remainder of the month should Chair Janet Yellen see greater scope to retain the highly accommodative policy stance for an extended period of time.

Risk: Bullish Argument/Scenario

|

Release |

Expected |

Actual |

|

Average Hourly Earnings (YoY) (AUG) |

2.1% |

2.1% |

|

Personal Consumption Expenditure Core (YoY) (JUL) |

1.5% |

1.5% |

|

Consumer Price Index ex Food and Energy (YoY) (JUL) |

1.9% |

1.9% |

Nevertheless, sticky inflation paired with the uptick in wage growth may spur a greater dissent within the committee and push the FOMC to lay out a more detailed exit strategy as the central bank looks to move away from its easing cycle.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI