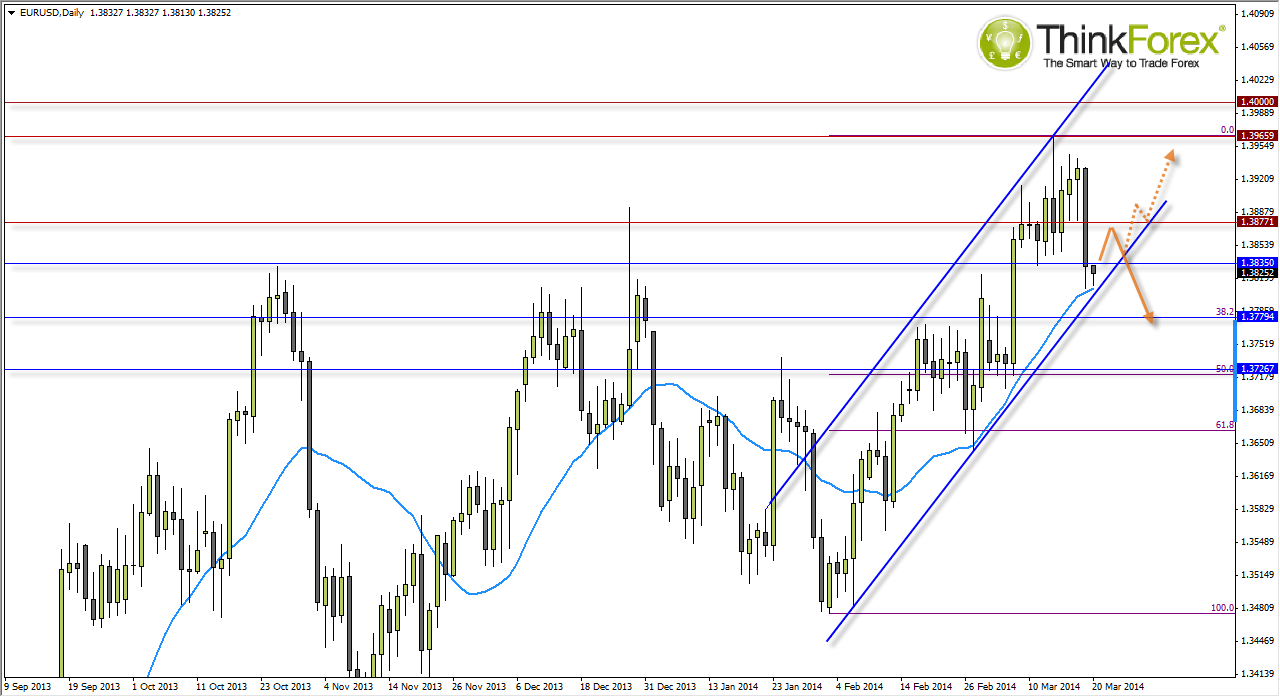

A week ago the euro provided clue of near-term weakness with a Shooting Star in heavy volume. Today it followed through with the threat of pending weakness.

EUR/USD Daily Chart" title="EUR/USD Daily Chart" width="674" height="642" />

EUR/USD Daily Chart" title="EUR/USD Daily Chart" width="674" height="642" />

Above is the euro Currency Basket which provides the volume data that sadly lacks. We can pay less attention to the price action as we take this from the EUR/USD pair, but take note of the volume produced on the chart above with the price action from the chart below.

Following the Shooting Star price traded inside the range of the candle, and while producing "up days" within the range. The daily range became increasingly narrow and produced further signs of weakness with A Spinning Top and a Hanging Man Reversal candle. Interestingly the candles within the range of the Shooting Star came following Draghi's comments during the ECB meeting to supposedly talk the euro down.

The final nail in the coffin came from the FOMC meeting which saw the Greenback gain strength across the board, and break below 2 key levels of support. Due to the elongated candle range yesterday on increased volume, I prefer a continuation and a deeper retracement. However, as we are still trading within the bullish channel and above the 21eMA I also see potential for a pullback prior to continued losses.

Should we break below the bearish channel my preferred method would be to see if we retrace to the lower channel to form resistance to achieve a potentially higher reward/risk ratio for short positions.

However, if we trade above 1.3877 resistance then I will assume a bullish continuation and seek bullish setups.

EUR/USD Daily Chart" title="EUR/USD Daily Chart" width="674" height="642" />

EUR/USD Daily Chart" title="EUR/USD Daily Chart" width="674" height="642" />

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.