Bitcoin price today: reaches new record high over $122k ahead of ’crypto week’

Talking Points

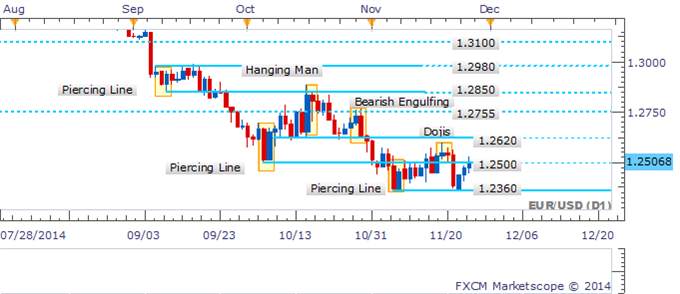

- Strategy:Short (From 1.2480), Stop: 1.2500 (Daily Close), Target 1: 1.2360, Target 2: 1.2250

- Slow Grind Higher Encounters Pressure At 1.2500 Barrier

- Awaiting Bearish Signals In Intraday Trade To Signal A Pullback

EUR/USD’s slow grind higher has endured, yet a lack of key bullish reversal patterns makes a more sustained recovery questionable. Sellers may look to keep the pair capped below the psychologically-significant 1.2500 handle. This in turn suggests current levels may offer a fresh short opportunity. An initial downside target is offered by the 1.2360 floor, which if broken would potentially open a run on the 1.2250 mark.

EUR/USD: Rebound May Struggle To Find Further Momentum

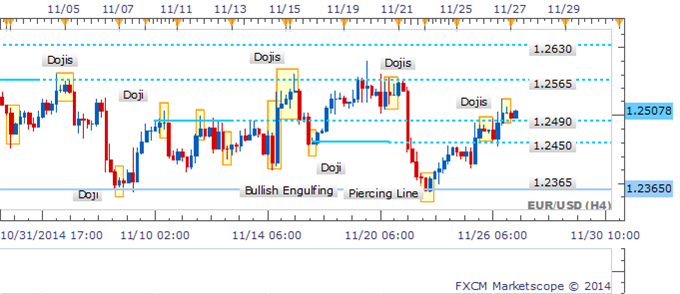

The four hour chart already reveals signs of hesitation from the bulls in the form of a Doji candlestick near the 1.2500 handle. Yet with more definitive reversal signals absent the potential for a pullback is questionable.

EUR/USD: Doji Signals Reluctance From The Bulls Near 1.2500

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.