EUR/USD for Monday, September 16, 2013

For the last couple of weeks the Euro has fallen strongly away from the resistance level at 1.34 back to below the support level at 1.32 and in doing so traded to its lowest level in seven weeks very close to 1.31. However in the last week or so it has reversed strongly and surged back through 1.32 and 1.33 and then started this week with a strong surger higher towards 1.3370. Despite a couple of rallies back above 1.32 a couple of weeks ago, it continued to drift lower and fall below 1.3150. For about a week or so a few weeks ago the Euro was placing upward pressure on the 1.34 level however it stood firm. About a month ago the Euro made a run at the 1.34 level only to be turned away yet again and ease back under – this was the story for several weeks. Several weeks ago it retreated heavily from above 1.34 after having reached a six month high around 1.3450. Despite its persistent attempts to push through the 1.34 level, it has only been consistently repelled with ample supply.

Looking at the bigger picture the Euro has spent most of the last six weeks or so trading within a range between 1.32 and 1.34. Back in early July the Euro was content to maintain the level above 1.31 and settle there, as it received solid support from both 1.30 and 1.31. On a couple of occasions it made an attempt to move within reach of the longer term resistance level at 1.32 and finally it finds itself trading on the other side of this level and being well established there. It has been some time since the Euro has experienced a 24 hour period with as much range as the period earlier in July when it surged higher from from below 1.28 up to above 1.32. Prior to that jump, the Euro had been in a very solid medium term down trend after succumbing to the resistance at 1.29 and moving down below the key long term level of 1.28. This resulted in it trading at a multi-year low near 1.2750.

Throughout May and most of June the Euro surged higher to a four month high above 1.34. Before that in the first half of May, the Euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the Euro received solid support around 1.28 and this level was called upon to provide additional support. Throughout this year the Euro has moved very strongly in both directions. Throughout February and March the Euro fell sharply from around 1.37 down to its lowest level since the middle of November around 1.2750. Sentiment has completely changed with the Euro over the last few weeks and the last couple of months has seen a rollercoaster ride for the Euro as it continued to move strongly towards 1.34 before falling very sharply to below 1.29 and setting a 6 week low.

Europe took a significant step forward in its ambitions to create a single banking framework for the euro zone last Thursday after EU lawmakers granted new powers to the European Central Bank to oversee the currency bloc’s banks. The plan approved by an overwhelming majority of the European Parliament will allow the ECB in Frankfurt to oversee around 6,000 banks in the 17 euro zone countries. While Thursday’s vote completes the last legislative step towards ECB supervision, many more challenging obstacles remain before banking union – which also hopes to establish a single euro zone authority to wind up bad banks – is finalized.

EUR/USD September 15 at 23:00 GMT 1.3370 H: 1.3382 L: 1.3295

During the early hours of the Asian trading session on Monday, the Euro has surged higher and moved up towards 1.3370 just shy of the long term resistance level at 1.34. Since the middle of June, the Euro has generally fallen sharply from new highs above 1.34, and has been looking to return back to the significant lows around 1.2800, however in the last month or so it has recovered well and moved back to above 1.34 again in the middle of August. Current range: right around 1.3370.

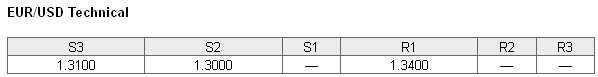

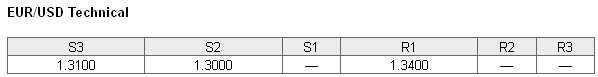

Further levels in both directions:

• Below: 1.3100 and 1.3000.

• Above: 1.3400.

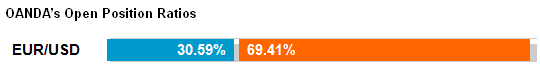

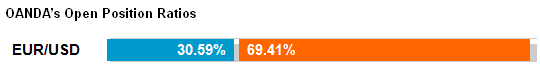

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio has fallen sharply back towards 30% as the Euro has surged back above 1.33. The trader sentiment remains strongly in favour of short positions.

Economic Releases

For the last couple of weeks the Euro has fallen strongly away from the resistance level at 1.34 back to below the support level at 1.32 and in doing so traded to its lowest level in seven weeks very close to 1.31. However in the last week or so it has reversed strongly and surged back through 1.32 and 1.33 and then started this week with a strong surger higher towards 1.3370. Despite a couple of rallies back above 1.32 a couple of weeks ago, it continued to drift lower and fall below 1.3150. For about a week or so a few weeks ago the Euro was placing upward pressure on the 1.34 level however it stood firm. About a month ago the Euro made a run at the 1.34 level only to be turned away yet again and ease back under – this was the story for several weeks. Several weeks ago it retreated heavily from above 1.34 after having reached a six month high around 1.3450. Despite its persistent attempts to push through the 1.34 level, it has only been consistently repelled with ample supply.

Looking at the bigger picture the Euro has spent most of the last six weeks or so trading within a range between 1.32 and 1.34. Back in early July the Euro was content to maintain the level above 1.31 and settle there, as it received solid support from both 1.30 and 1.31. On a couple of occasions it made an attempt to move within reach of the longer term resistance level at 1.32 and finally it finds itself trading on the other side of this level and being well established there. It has been some time since the Euro has experienced a 24 hour period with as much range as the period earlier in July when it surged higher from from below 1.28 up to above 1.32. Prior to that jump, the Euro had been in a very solid medium term down trend after succumbing to the resistance at 1.29 and moving down below the key long term level of 1.28. This resulted in it trading at a multi-year low near 1.2750.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Throughout May and most of June the Euro surged higher to a four month high above 1.34. Before that in the first half of May, the Euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the Euro received solid support around 1.28 and this level was called upon to provide additional support. Throughout this year the Euro has moved very strongly in both directions. Throughout February and March the Euro fell sharply from around 1.37 down to its lowest level since the middle of November around 1.2750. Sentiment has completely changed with the Euro over the last few weeks and the last couple of months has seen a rollercoaster ride for the Euro as it continued to move strongly towards 1.34 before falling very sharply to below 1.29 and setting a 6 week low.

Europe took a significant step forward in its ambitions to create a single banking framework for the euro zone last Thursday after EU lawmakers granted new powers to the European Central Bank to oversee the currency bloc’s banks. The plan approved by an overwhelming majority of the European Parliament will allow the ECB in Frankfurt to oversee around 6,000 banks in the 17 euro zone countries. While Thursday’s vote completes the last legislative step towards ECB supervision, many more challenging obstacles remain before banking union – which also hopes to establish a single euro zone authority to wind up bad banks – is finalized.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

EUR/USD September 15 at 23:00 GMT 1.3370 H: 1.3382 L: 1.3295

During the early hours of the Asian trading session on Monday, the Euro has surged higher and moved up towards 1.3370 just shy of the long term resistance level at 1.34. Since the middle of June, the Euro has generally fallen sharply from new highs above 1.34, and has been looking to return back to the significant lows around 1.2800, however in the last month or so it has recovered well and moved back to above 1.34 again in the middle of August. Current range: right around 1.3370.

Further levels in both directions:

• Below: 1.3100 and 1.3000.

• Above: 1.3400.

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio has fallen sharply back towards 30% as the Euro has surged back above 1.33. The trader sentiment remains strongly in favour of short positions.

Economic Releases

- 09:00 EU Employment (Q2)

- 09:00 EU HICP (Final) (Aug)

- 09:00 EU Labour Cost Index (Q2)

- 12:30 US Empire State Survey (Sep)

- 13:15 US Capacity utilisation (Aug)

- 13:15 US Industrial production (Aug)

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI