Intel, GlobalFoundries gain as U.S. plans to reduce reliance on chip imports

Ethereum's energy consumption will drop dramatically as it transitions from mining to staking.

Key Takeaways

- Ethereum is transitioning to proof-of-stake, which will reduce its energy consumption dramatically.

- The Ethereum Foundation expects that the blockchain's power consumption will drop by more than 99%.

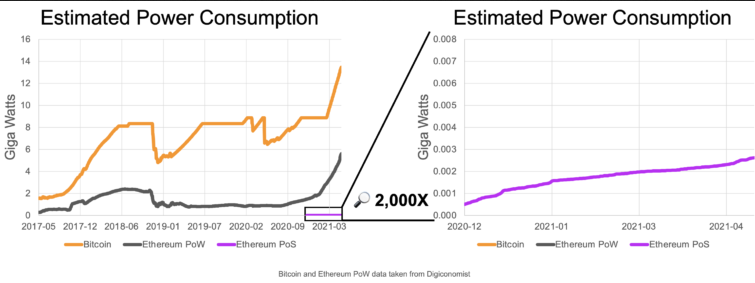

- Ethereum will be about 7,000 times more energy efficient than Bitcoin, which continues to rely on mining.

Ethereum will reduce its energy consumption by 99.95% following its transition to proof-of-stake, according to a new blog post from Carl Beekhuizen of the Ethereum Foundation.

How Much Less Energy Will ETH Use?

Beekhuizen estimated there are 87,000 at-home stakers using about 100W of energy for a total of 1.64 megawatts. Additionally, there are another 52,700 exchanges and custodial services that use about 100W per 5.5 validators for a total of 0.98 megawatts.

Based on those estimates, Beekhuizen says that Ethereum will consume about 2.62 megawatts when it switches to proof-of-stake.

Beekhuizen added that this estimate may be too large. He noted that his own personal staking setup was optimized to use 15W, while some staking services use as little as 5W per validator.

This means that Ethereum will no longer use the energy equivalent of a country or even a city. Instead, its total consumption will be comparable to a small town that contains around 2100 homes.

Additionally, Beekhuizen drew attention to the fact that Ethereum’s proof-of-stake network will be approximately 7,000 times more energy efficient than Bitcoin, as seen in the chart below:

Staking Will Use Some Energy

Though this reduction in energy consumption was expected, the Ethereum Foundation is clearly attempting to be transparent by indicating that proof-of-stake nodes do consume some energy.

But unlike the mining system that Ethereum currently relies on, staking participants will not competitively use energy to discover a block. Instead, block discovery will be based on the amount of ETH that a user has staked along with various related factors.

The news is especially relevant in light of Tesla's (NASDAQ:TSLA) decision to drop Bitcoin payments due to the fact that Bitcoin mining demands large amounts of energy. It is not clear if the firm is considering ETH.

Which stocks should you consider in your very next trade?

The best opportunities often hide in plain sight—buried among thousands of stocks you'd never have time to research individually.

That's why smart investors use our Stock Screener with 50+ predefined screens and 160+ customizable filters to surface hidden gems instantly.

For example, the Piotroski's Picks method averages 23% annual returns by focusing on financial strength, and you can get it as a standalone screen. Momentum Masters catches stocks gaining serious traction, while Blue-Chip Bargains finds undervalued giants.

With screens for dividends, growth, value, and more, you'll discover opportunities others miss. Our current favorite screen is Under $10/share, which is great for discovering stocks trading under $10 with recent price momentum showing some very impressive returns!