I just realized something odd that never occurred to me before: pizza was instrument to computers entering the households of America.

To explain:

- In the mid-1970s, good quality video games were far too expensive for a typical consumer, but most local pizza joints could afford the few thousand bucks that they cost;

- Kids and teens would flock to these places (I was one of them) in the late 1970s and drop in quarters with abandon;

- Eventually, the ability to play games was made accessible and affordable, so American families had the incentive to spend a few hundred bucks to bring the aforementioned electronics into the home;

- Once consumer electronics (in the form of Atari, Nintendo, etc.) were popularized, it paved the way for the superset of video game controllers, which was the personal computer.

This occurred to me because of what happened this month with PayPal (NASDAQ:PYPL) and crypto. To my way of thinking, permitting the countless millions of people who use Paypal every day, a very simple and already-in-place means of buying and selling crypto, was a sea-change in how popular an “investment” (if you want to call it that) vehicle that cryptos are.

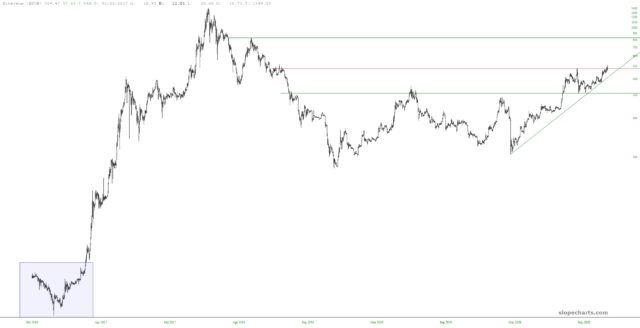

About a week ago, I wrote enthusiastically about Ethereum, and it looks like things are really starting to cook there.

Of course, unlike Bitcoin, it is not near its lifetime highs. On the contrary, it’s still worth only about one-third of its peak. But the bullish formation is quite impressive.

If Bitcoin manages to cross above its own lifetime high of about$20,000, I believe Ethereum will keep racing higher, chasing Bitcoin, particularly since Bitcoin’s besting of its prior high will get a lot of mainstream press.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.