Several readers have asked about the auto loan component of the US consumer credit growth (discussed earlier). The Fed doesn't provide this data directly, but there are a couple of ways to assess the trend in auto related credit growth.

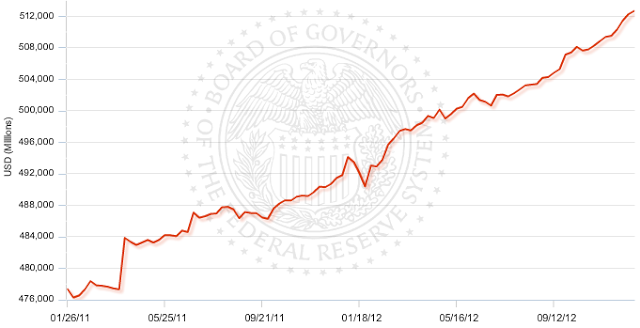

1. The Fed shows two components of consumer credit on banks' balance sheets. The first is all the revolving credit (mostly credit card debt) shown in the previous post. The second component is what they label as "Other consumer loans." Taking all the consumer debt without mortgages (shown separately) and credit cards (the first component), we are left primarily with auto loans and private student loans (government sponsored student loans are now held by the federal government). Given that private student loans tend to be crowded out by the government programs, one could conclude that a large part of this portion of the banks' balance sheets represents auto loans.

That component has indeed been growing, increasing by some $21bn during 2012. Though it's a large number, it makes up about 7.5% of the total increases in loans and leases for the year. Part of the issue with this measure however is that when it comes to auto loans, not all of the debt is held by banks. A great deal is held by finance companies and ultimately securitized (as demand for asset backed securitizations has been on the rise).

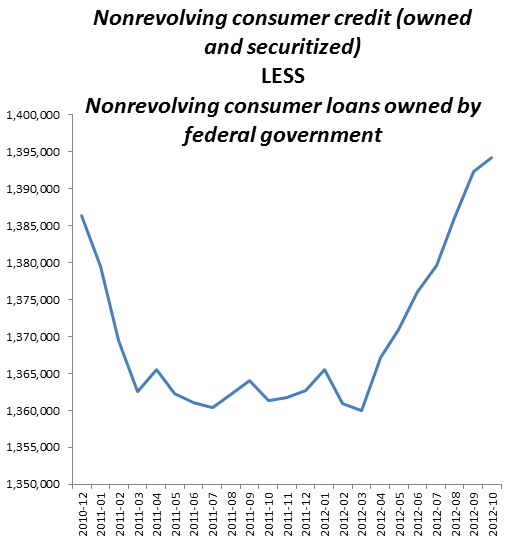

2. It therefore makes sense to look at the problem from the consumer debt perspective (as opposed to bank balance sheets). The Fed provides monthly consumer debt outstanding broken down by revolving and non-revolving loans. Taking the non-revolving loan balances (including securitizations) and subtracting government held student loans should provide an estimate of auto loans outstanding (although the measure is still "polluted" by private student loans). By that measure total auto loan balances only started growing in 2012, rising about $32bn for the year.

Unfortunately this measure is on a two-month lag and therefore incomplete for the purposes of assessing credit expansion for 2012.

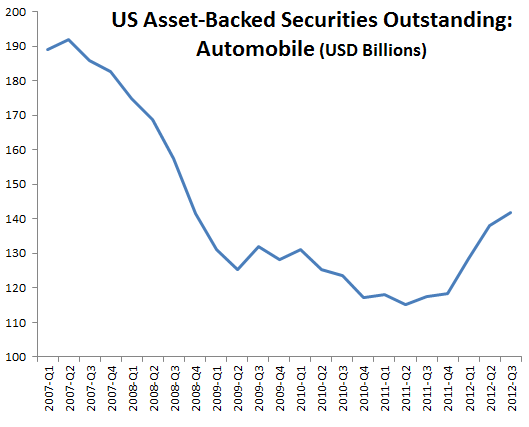

3. Another measure that supports the estimate above can be obtained from SIFMA. It is the total auto ABS (securitized auto loans) outstanding reported on a quarterly basis.

The data also shows an increase in auto loans during the first three quarters of 2012 on the order of $24bn in ABS securitization alone.

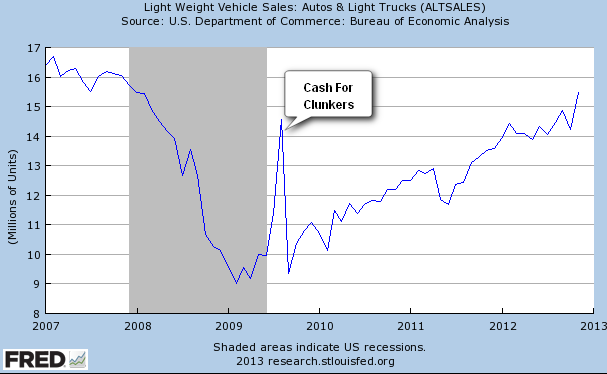

Even if the exact amount is difficult to estimate at this stage, it is clear from the above three measures that the US experienced a decent size expansion in auto loans during 2012 (although it is still a fraction of corporate lending taking place last year). And that credit expansion in turn helped drive brisk auto sales that exceeded the Cash For Clunkers program in 2009.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI