Asia stocks dither amid Trump tariff fears, mixed China inflation

ES Completed the Red Topping Triangle with a Fake Breakout Through and Topping Formation at the Top and Should Break Out Downwards to Take Out the August 24 Low

Today, ES completed a fake breakout and topping formation at the top of the red triangle to top the move out of the August 24 low.

The way these tops typically play out is with a retrace to the triangle top and then a breakout through the formation bottom.

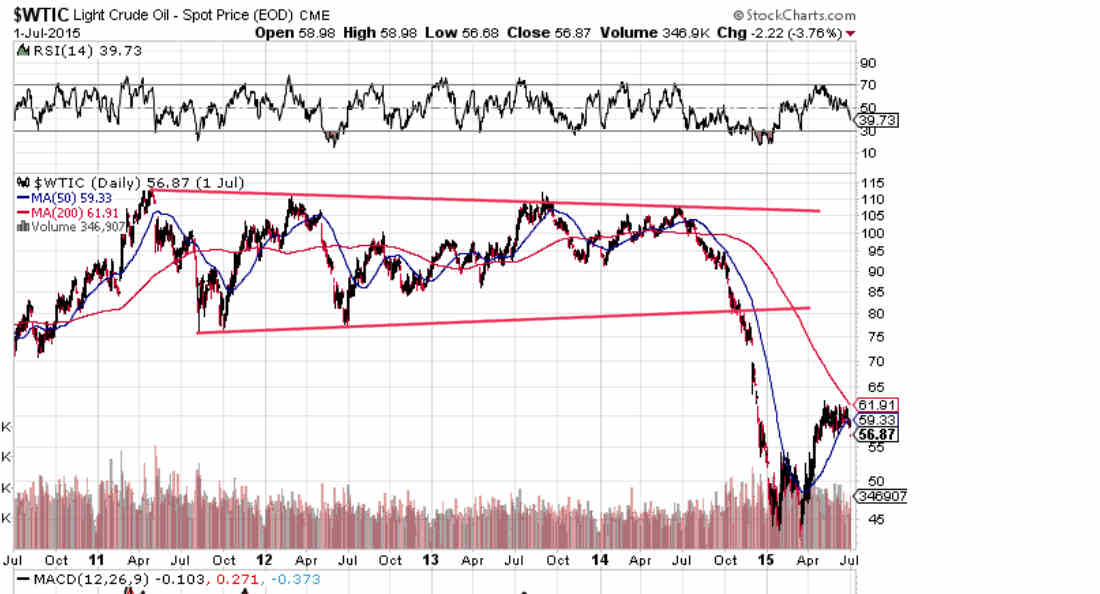

Oil Topping Triangle

Here is a long-term topping triangle example on oil. The fake breakout and topping pattern at the top are difficult to see, so I include a closer look below.

Example of Topping Triangle on Oil

Note the Similarities Between the ES Topping Triangle and this Oil Topping Triangle

Details of Topping Triangle Structure

Note the similarities between the ES triangle and the close-up view of the oil topping triangle. The final wave up of both bogged down around the triangle middle before melting up in a rising wedge to a fake breakout through the triangle top. Then a head and shoulders completed with a neckline at the triangle top before the price broke back into the triangle.

All of this is pretty much standard for this type of topping triangle.

Most of these triangles put in a hard wave down upon reentry into the topping triangle. We got that move down in ES today, and you can see oil’s reentry into its topping triangle below.

Oil Reentered Its Topping Triangle with a Hard Wave Down

Oil put in a megaphone at this point to swing the price up for a retest of its triangle top before breaking out the bottom. ES is likely to do the same thing before breaking out the bottom of its topping triangle.

Topping Triangles Tend to Break Out into Strong Moves Down

Topping triangles tend to result in strong moves down because many traders don’t accept the idea of a topping triangle and see the internal structure of the formation as bullish. So they tend to be positioned incorrectly for the breakout.

Whether you think this formation should be called a topping triangle or something else, it’s worth paying attention to the details of the formation structure because you will see a lot of them on all time frames and they are strong trading set-ups.