Stock market today: S&P 500 ekes out gain as Trump says open to deals on tariffs

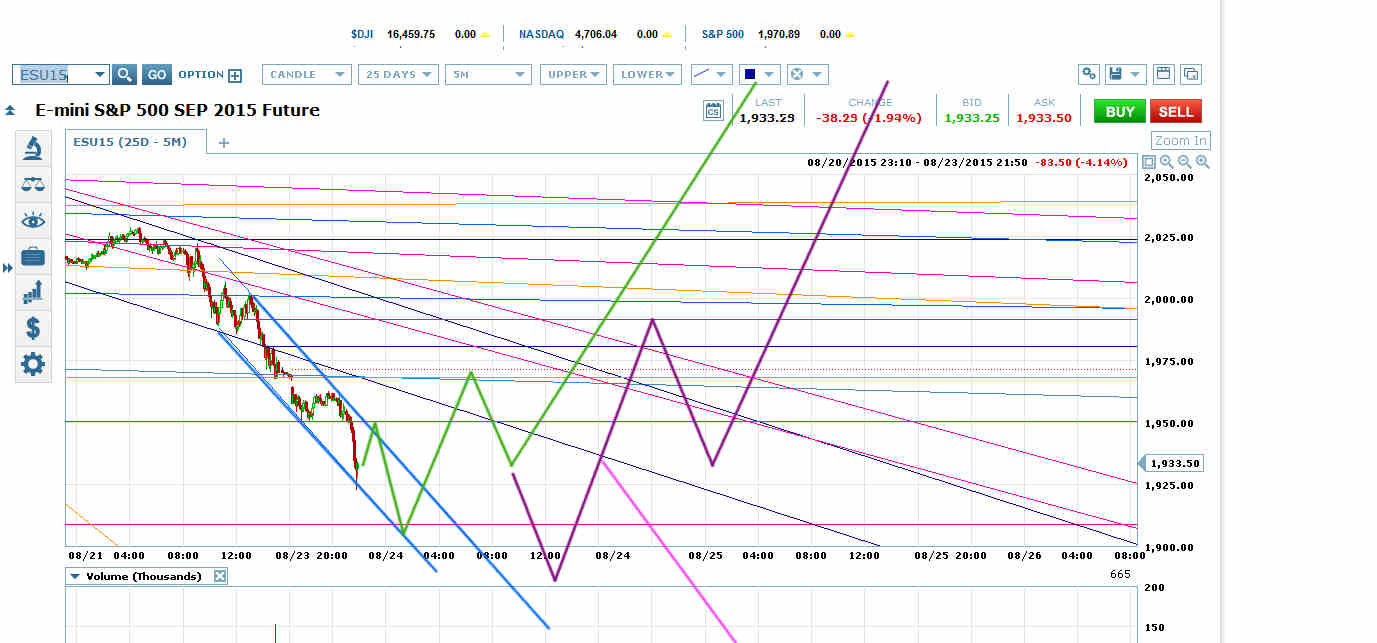

ES Price Action in the Navy Blue and Bright Blue Price Channels is Maxed Out – Means ES is Starting a Consolidation or Bottom

ES has put in the max number of alternating touches on its price channel (navy blue) and melt-down channel (bright blue) before it must start a bottoming or consolidation pattern.

It will still likely put in lower lows as it bottoms or consolidates. It will almost certainly tag the bottom of its rising megaphone top. From there, you would usually see a bounce into the right shoulder of the H&S on the daily and weekly charts.

Usually a tag of the bottom at this point in the rising megaphone would mean that the top is already in. There are some rare exceptions, and if I see one developing, I’ll post it.

The minimum right shoulder retrace target is 2080. ES is likely to get to 2103 or even 2113.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI