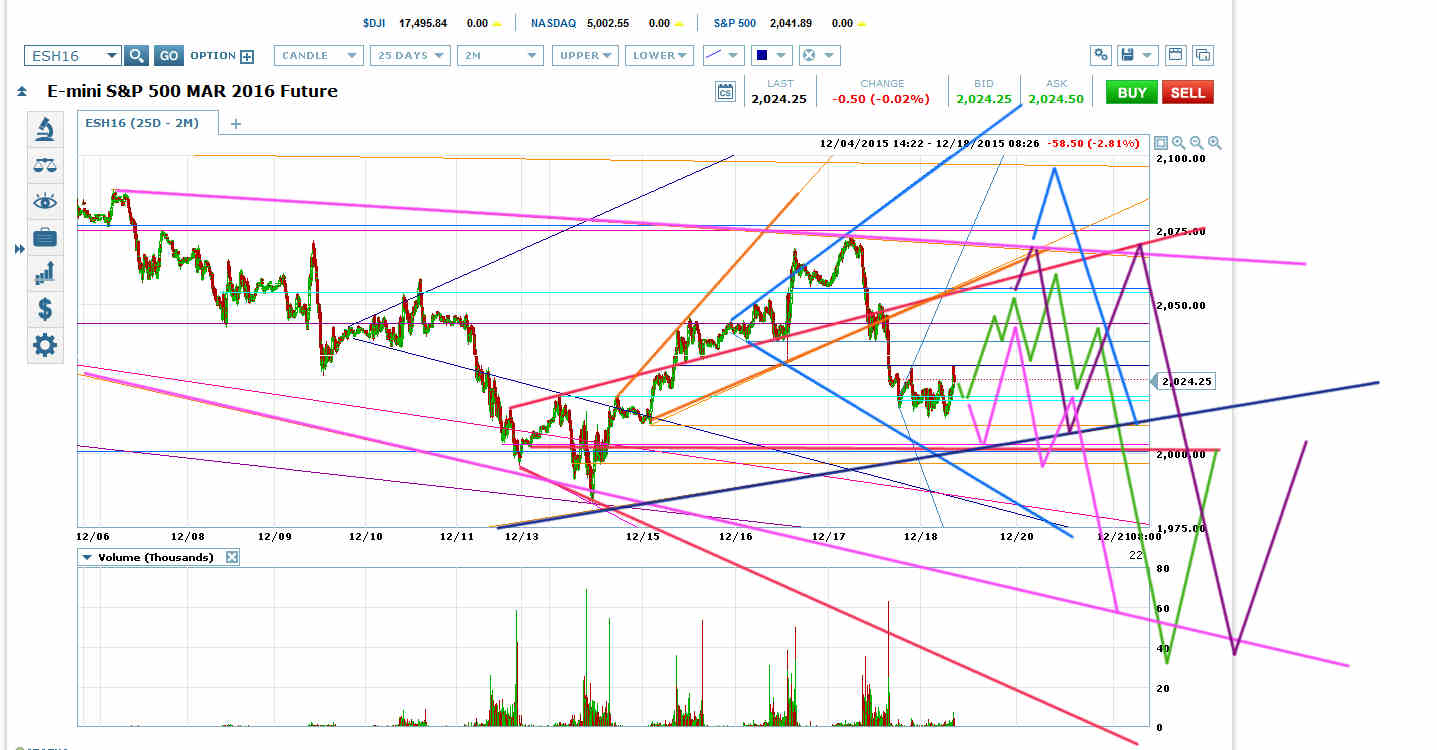

ES is Working on a Megaphone Bottom for Last Night’s Dip Before a Rally to at Least the Blue Megaphone VWAP

ES is completing a megaphone bottom on last night’s dip to roughly 2011.50. That was the retrace target for the orange rising megaphone. A lower low would be enough to complete the requirement for a retrace to the red megaphone VWAP. Otherwise a reversal at roughly 2017 this morning means that’s as close as ES is going to get before its mandatory retrace to the bright blue megaphone VWAP at 2044.

ES could form a top at or across 2044 (green and pink scenarios) for a plunge to the red megaphone bottom at 1950. Or ES could continue up to the top of its potential pink falling megaphone at roughly 2070 and put in a holiday triangle between that line and the navy blue line near 2000, which represents the bottom of a potential rising megaphone off the August 24 low (purple scenario).

ES could even kill the pink falling megaphone with a move back up to 2100, though that’s unlikely.

The green or pink scenario would normally be at least a 3-to-1 favorite, but the holiday break may raise the odds of the purple scenario.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI