Novo Nordisk cuts full-year sales and profit guidance, stock plunges

In order for ES to break out upwards on a sustained run to a substantially higher high, it needs to get bears back in the game.

What this would take is something like a large, clear H&S on the daily chart, with a lot of people shorting at the expected area of the right shoulder top. A right shoulder failure and an upwards breakout from the H&S would melt the market up to a substantially higher high.

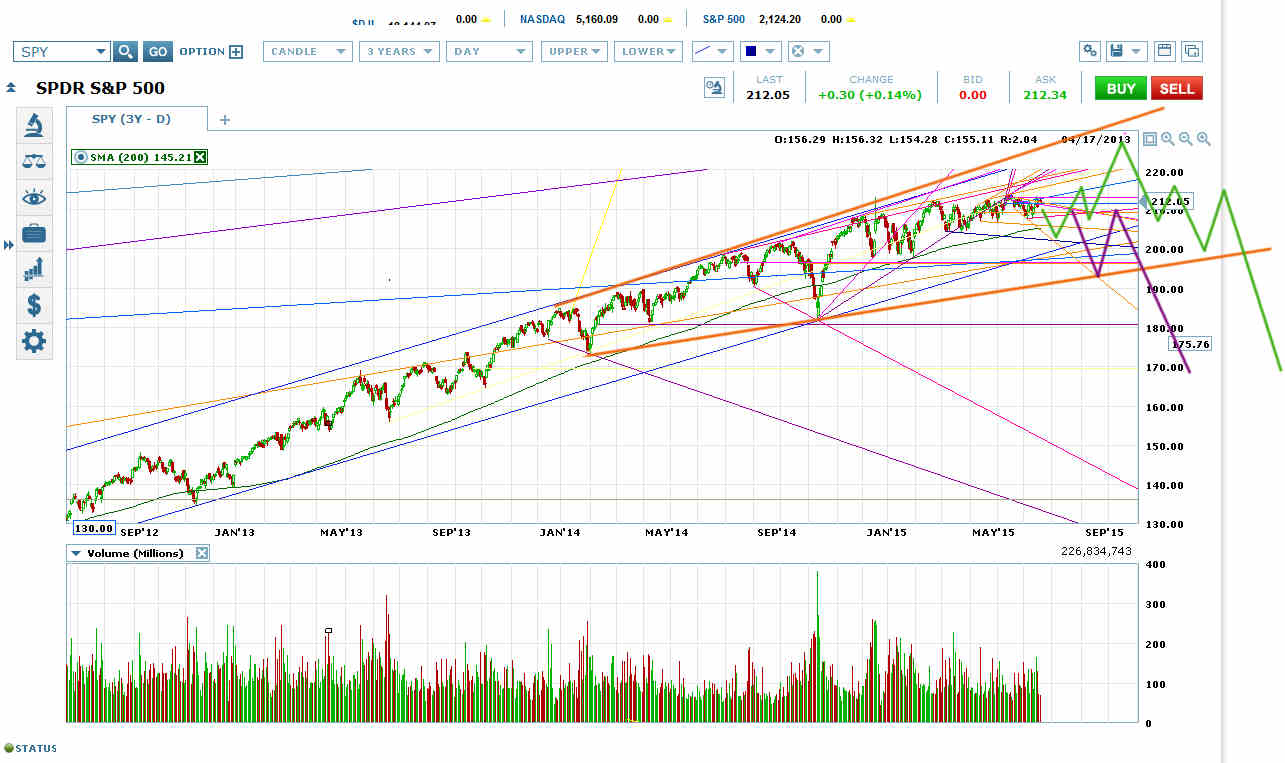

But once ES reaches the bottom of its long-term rising megaphone top (orange on chart above), the top would almost always be in. There is usually a bounce off the bottom of a rising megaphone, but that bounce usually puts a right shoulder on an H&S that will actually break out downwards.

So one way to look at the long-term SPDR S&P 500 (ARCA:SPY) or ES chart is that it’s working right now on the head of a head and shoulders that is working the price across the orange rising megaphone for a breakout downwards. That head could still take the price a lot higher, but the market probably needs to move lower first to recharge for such a move.

And ES has to move down to the March low soon to preserve the bullish option. The bottom of the orange rising megaphone is an up-tilting line. If ES moves sideways too much longer before retracing to the March low, it will run into the bottom of the orange rising megaphone on that retrace, and that would usually be a sign of impending doom.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.