Consistent messaging from the Epwin Group PLC (LON:EPWN) team continued with a year-end update that confirmed that FY18 trading had been in line with market expectations. The theme of self-help given market headwinds is ongoing with tangible evidence of actions taken and planned. Market backdrop uncertainty is reflected in Epwin’s rating multiples. A dividend yield approaching 7% (c 1.9x covered) should be of interest to investors.

H2 progress, net debt below 1x EBITDA

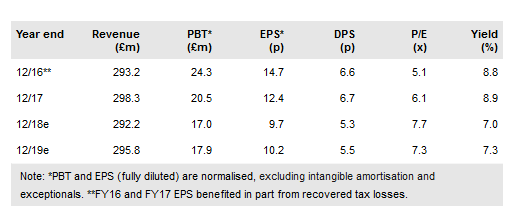

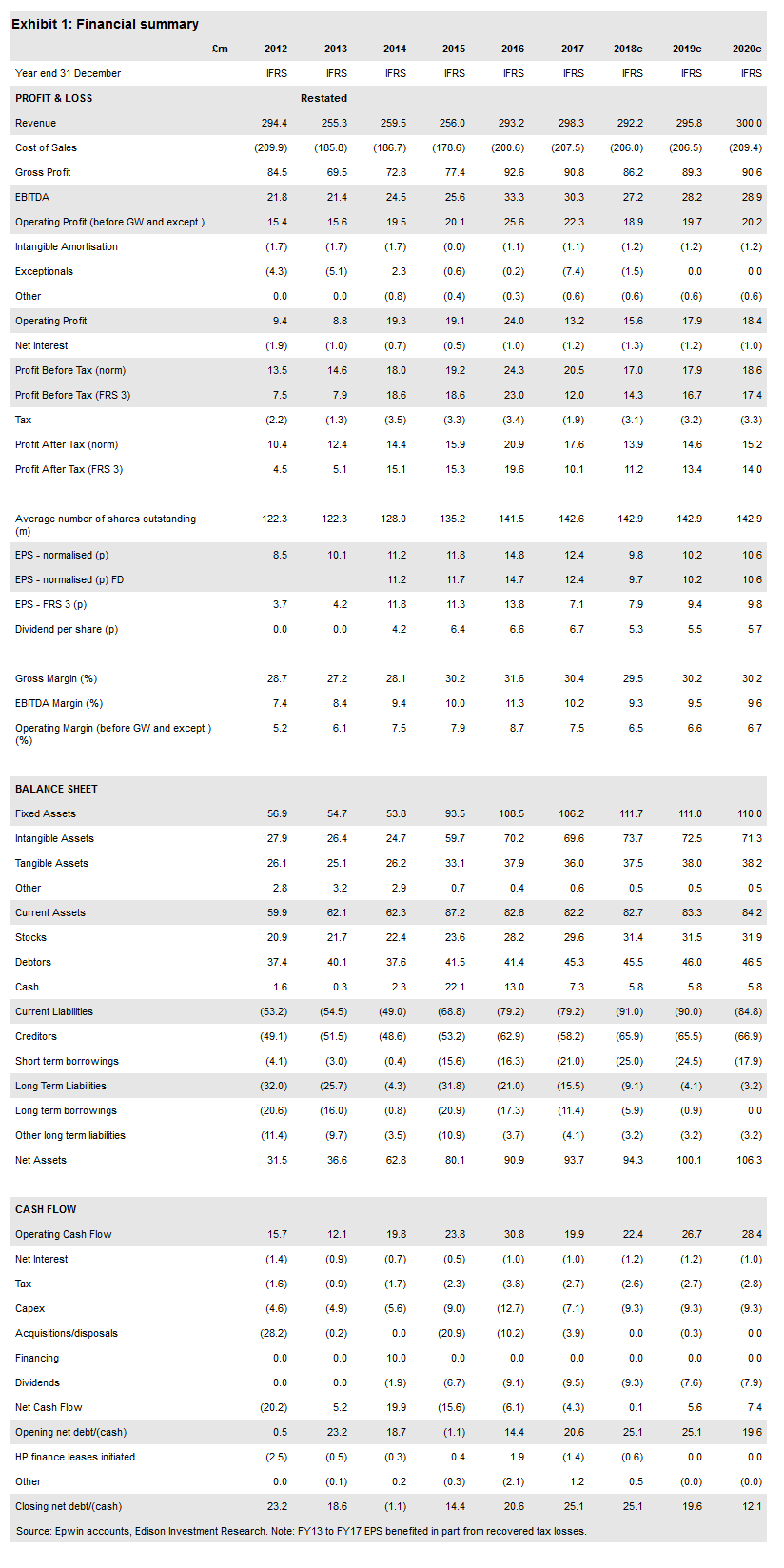

FY18 ended in line with a narrow range of market expectations, which confirms a material improvement in H2 profitability was achieved versus H1. This is partly a normal seasonal effect but also shows some year-on-year progress, demonstrating some recovery from previously noted customer ownership changes. Operational improvements – including exits from two sites (Cardiff and Macclesfield) – and a contribution from Amicus (the 15-branch building products distribution business acquired in March) would have contributed to this outturn, which was achieved despite input cost pressures (especially PVC). Management commented that year-end net debt was less than 1x EBITDA in the year and our c £25m expectation (vs EBITDA of c £27m) is consistent with this and suggests good cash flow control.

More self-help actions in uncertain markets

Reference to macroeconomic and Brexit uncertainty is now commonplace in trading updates. Epwin has repeated this business caveat and expects no RMI rebound in FY19. The post year-end disposal of glass sealed unit manufacturing operations (likely to give rise to an exceptional charge in discontinuing this business) and proposed new warehouse facility at Telford (completion likely by the end of FY19) are further examples of internal actions being taken to enhance business resilience and core growth prospects in challenging markets. These features aside, volume growth, new product sales – including aluminium window systems - and the extent to which polymer price changes need and are able to be passed through to customers will remain the primary drivers of profitability in FY19.

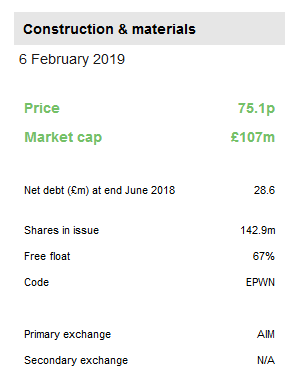

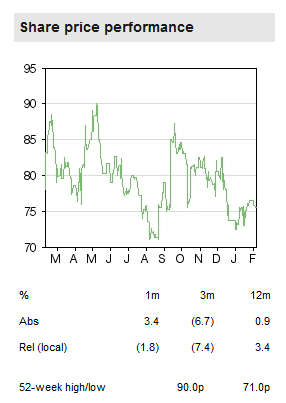

Valuation: Expecting earnings progress from FY19

Epwin’s share price currently sits in the lower half of its 12-month 71–90p trading range, being modestly above December levels. Investor sentiment towards cyclical stocks weakened noticeably in Q418 and the shadow of Brexit is creating uncertainty over future economic growth rates. On our estimates, Epwin is now trading on a trailing year P/E of 7.7x, EV/EBITDA of 4.9x and a dividend yield of almost 7% (covered c 1.9x). We expect FY18 to be an earnings low point with gradual growth to resume from FY19.

Business description

Epwin Group supplies functional low-maintenance exterior building products (including windows, doors, roofline and rainwater goods) into a number of UK market segments and is a modest exporter. It has a vertically integrated model in windows and doors, and a leading market position in roofline products.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI