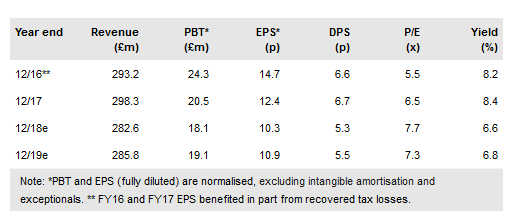

Epwin Group PLC (LON:EPWN): A short AGM update statement echoed previous management comments regarding market conditions and (unchanged) FY18 expectations. This suggests that the underlying trading environment is broadly stable and actions being taken to improve operational efficiency are proceeding to plan. The share price performance will be driven by delivery against these expectations and/or any indication of more robust market conditions, in our view. Ahead of such a catalyst, the prospective 6.6% dividend yield is a clear incentive to invest.

Taking positive actions in mixed markets

Management appears to be navigating mixed market conditions reasonably well – including selective price increases – in addition to progressing internal initiatives. Operational efficiency is a key focus for Epwin this year as two unexpected end customer issues that arose in FY17 flow through into FY18. Glass (sealed unit) operations were consolidated last year and further footprint actions are being taken in both profile extrusion and door fabrication. We believe that these actions were fully provided for in FY17 with expected completion during Q119. Elsewhere, Amicus (a 15-branch distribution business, acquired earlier this year) is bedding in and should make a modest profit contribution this year.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.