Bitcoin price today: reaches new record high over $122k ahead of ’crypto week’

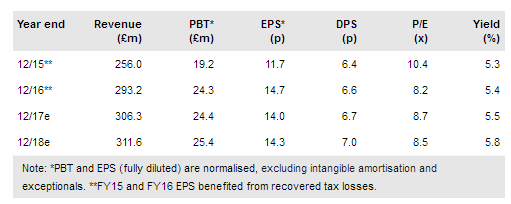

Trading in the first four months of FY17 has been in line with management expectations and our estimates are unchanged. Market commentary is cautious, but as outlined in our recent note Epwin Group (LON:EPWN) has a number of internal initiatives underway to further improve the business and mitigate near-term input cost pressures. In our view, longer-term prospects are somewhat better than the current rating is implying.

A steady start to the year

For the UK building materials sector, Q2, Q3 and into Q4 are the busiest periods, but it is encouraging to know that the first four months of Epwin’s trading year have met management expectations. Industry-wide materials input cost rises have been flagged previously and there appears to be no additional caution in this area. In flat RMI markets, Epwin is focusing on operational improvements (eg in fabrication) and marketing initiatives (eg branding and range development of window systems and canopy products plus greater co-ordination across group companies). H117 will benefit from an extra five months of National Plastics trading and we expect Fabrication & Distribution to show a more robust y-o-y performance. We will take a view on the likely shape and quantum of H117 results at the end of the half year.

To read the entire report Please click on the pdf File Below

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI