Operating performance across all Entertainment One Ltd (LON:ETO) (eOne) divisions is in line with management’s full year expectations, with the H1/H2 weighting expected to be broadly in line with last year. As the group’s business grows, so does its library valuation, which has increased by 13% y-o-y to $1.7bn, underpinning c 80% of the current EV.

Full year outlook reiterated

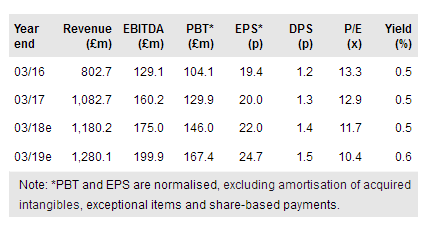

Operating performance is on track to meet full year expectations with the H1/H2 weighting of performance similar to last year. Management has also reiterated its expectation of a net debt to EBITDA ratio of c 1.2x at the end of the year.

To read the entire report please click on the pdf file below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.