Entertainment One Ltd (LON:ETO): An excellent performance in Television and Family and the recovery in Box Office in Film underpinned strong revenue and EBITDA growth in FY17 and the outlook for FY18 remains positive. The efforts that the group has made to move closer to the creative process in Film, and to diversify beyond Film, has greatly improved the financial and risk profile. We expect the ratings gap to peers to narrow.

Television and Family power growth, Film stable

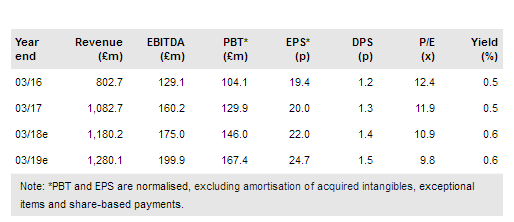

Revenues increased 35%, 8pp ahead of our estimates with an exceptional performance from Television (+85%) and Family (+33%) and the Sierra acquisition supporting the Film division’s overall growth (+7%). Currency and acquisitions contributed 15% and 6%, respectively. EBITDA growth of 24% lagged revenue growth due to mix effects, but was broadly in line with our forecast as was adjusted EPS at 20.0p. Net debt increased slightly to £187.5m (1.2x EBITDA) and a dividend of 1.3p has been proposed.

To read the entire report Please click on the pdf File Below

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI