US broad market rebounds after three-session slide

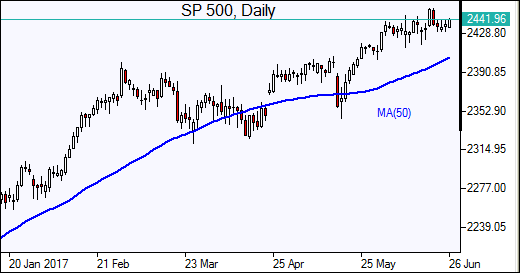

US stocks closed higher on Friday. The dollar weakened: the live dollar index data show the ICE US dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched down 0.28% to 97.256. S&P 500 ended 0.2% higher at 2438.30 led by energy stocks.

The Dow Jones industrial average finished little changed at 21394.76. A preliminary reading on purchasing managers’ indexes on manufacturing in June showed expansion continued in the sector while the index fell to 52.1, a nine-month low. Sales of new homes rebounded in May. The NASDAQ composite index rose 0.5% closing at 6265.25.

European stocks lower on mixed data

European stock indices slipped on Friday on mixed data. Both the euro and British pound ended higher against the dollar.

The Stoxx Europe 600 index closed down 0.2% as flash readings of purchasing managers’ indexes for manufacturing and services in the euro-zone were lower for June. The DAX 30 fell 0.5% to 12733.41. France’s CAC 40 ended 0.3% lower and UK’s FTSE 100 lost 0.2% to 7424.13. Indices opened 0.3% -0.6% higher today.

Asian stocks start week up

Asian stock indices are rising today. Nikkei closed 0.1% higher at 20153.35 today as yen reversed four-day winning streak against the dollar. The Chinese stocks are higher as concerns about tightening liquidity following close regulatory scrutiny of major dealmakers Anbang and Dalian subsided: the Shanghai Composite Index is up 0. 9%, and Hong Kong’s Hang Seng Index is 0.7% higher. Australia’s ASX All Ordinaries is up 0.1% supported by higher commodity stocks despite a stronger Australian dollar against the greenback.

Oil up despite rising US rig count

Oil futures prices are higher today while traders are concerned about higher US oil production contributing to sustained global oversupply. Despite OPEC led initiative including major producers like Russia to cut production to tighten the market. The US oil rig count rose by 11 last week, 23 weeks in a row. Prices ended higher on Friday: August Brent crude gained 0.7% settling at $45.57 a barrel on London’s ICE Futures exchange. It lost 3.9% in the week.