The first half of the year may have ended already, but market themes that have been persistently with us for the first 6 months of the year are still around.

Yesterday’s Eurozone inflation number is a case in point. Overall preliminary CPI for the Eurozone in the month of June remained at the cyclical lows of 0.5% although core prices, with food and energy movements removed, tickled higher to 0.8% from a year ago.

The problem of low inflation is a common one in G10 economies at the moment. The Federal Reserve doesn’t deem that the US economy will be able to conjur up a 2.0% PCE number before the end of 2016 while CPI in the UK slipped to a 4yr low in May. Japan is attempting to create lasting inflation but may well fail once the impact of April’s VAT increase is taken out of the calculations and the Japanese consumer base cuts spending as real wages steadily decline.

What yesterday’s CPI number from the Eurozone did is guarantee that the ECB meeting on Thursday will revolve solely around the speech and press conference of ECB President Mario Draghi. Policy changes will only happen on the basis of changes to longer-term inflation and growth forecasts that next occur in September and December.

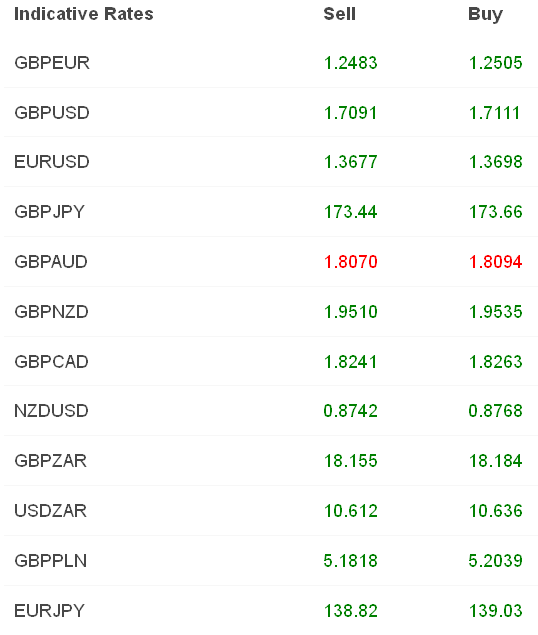

USD weakness has also been the hallmark of 2014 so far; some of it deserved, some of it not. GBP/USD stretched to fresh highs above 1.71 and EUR/USD made an attempt at 1.37 yesterday afternoon as month-end flows socked the USD. Month-end rebalancing of investment and pension portfolios by their respective managers is a common mover on the last day of a month. Yesterday also marked the end of the quarter and the half-year of course and hence the large movements.

Overnight action has focused on the beginning of today’s run of manufacturing PMIs from the world economy. According to last night’s number China’s manufacturing sector is now expanding at its best rate this year, coming in at 51.0 with the new orders subindex the highest since 2012, garnering hopes that this is not just a flash in the pan and that momentum can be maintained. Whether we put this down to the benefits of the mini-stimulus package or the simple resumption of demand from the US economy following its poor Q1 remains to be seen. Those wary of where Chinese growth is coming from will not be swayed by this number but investors are taking comfort in the positivity. Chinese authorities also allowed banks from last night to increase their loans to the ratio of their deposits via new lending rules.

PMI readings from Eurozone member states’ manufacturing sectors are of course due this morning as well. The various price indices will be able to show us whether input prices of raw materials are falling and whether manufacturers, particularly in the periphery are having to cut margins further to respond to low consumer demand. Italy’s is due at 08.45, France at 08.50, Germany at 08.55, the Eurozone at 09.00 – all times BST.

The UK number is due at 09.30 and is expected to remain in the mid-to-high 50.0s – strong but not exceptional. Those who are looking for interest rate increases in the UK before year end will be looking for an increase in manufacturing employment and subsequent wage increases in specialised areas. A pick-up in input and output prices would not go amiss either.

The US ISM at 15.00. As we stated last week, should last week’s preliminary PMI reading be repeated at the official reading next week, it will be the 2nd highest survey reading in the history of the Markit survey. Admittedly this survey is only a few years old but the correlation with the ISMs has been encouraging. All parts of the manufacturing sector were shown to have increased in June; prices, wages and jobs are the obvious highlights.

Japan’s Tankan survey has shown Japanese business standing ready to invest in capital spending through the next year however large manufacturers reported its first slip in sentiment since December of last year. Prime Minister Abe will be happy to hear that spending on capital is set to increase by 7.4% given the decrease in consumption. JPY is slightly lower on the session.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI