USD/JPY has turned nicely down from above 104.00 levels where we see completed wave C) that belongs to a triangle formation about we already discussed last week. So far that was a very sharp downward reaction, but we should not fall in love with bearish trend too soon as waves D) and E) are still needed to complete a triangle formation in blue wave four of a higher degree. That said, in the near-term support can be seen at 100.00/100.50 region.

USD/JPY, 4H

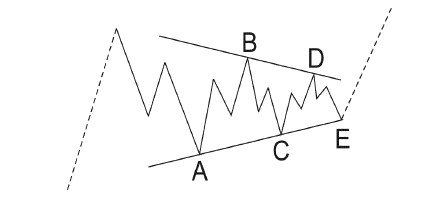

A Triangle is a common 5 wave pattern labeled A-B-C-D-E that moves counter-trend and is corrective in nature. Triangles move within two channel lines drawn from waves A to C, and from waves B to D. A Triangle is either contracting or expanding depending on whether the channel lines are converging or expanding. Triangles are overlapping five wave affairs that subdivide into 3-3-3-3-3.

Basic Triangle Pattern:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI