Novo Nordisk cuts full-year sales and profit guidance, stock plunges

USD/CHF has made a big pullback since end of 2015 that we see it as a corrective and temporary decline. Notice that falling price action was overlapping; thus it has evidence of a contra-trend movement so we suspect that downtrend is finished now, especially after we identified an ending diagonal in wave C-circled of a big wave IV.

Ideally, the market is now making a new bullish turn up into wave V that should be made by three waves. If we are correct, then current triangle represents wave B-circled that will send price up into wave C later this month. Decisive rise above the upper channel resistance line will confirm our bullish view.

On the other-hand, a break beneath 0.9444 swing would require a different outlook.

USD/CHF Daily

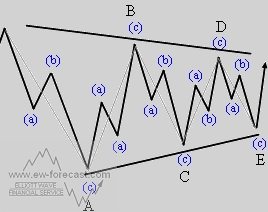

A triangle is a common 5 wave pattern labeled A-B-C-D-E that moves counter-trend and is corrective in nature.

Triangles move within two channel lines drawn from waves A to C, and from waves B to D.

A triangle is either contracting or expanding depending on whether the channel lines are converging or expanding.

Triangles are overlapping five wave affairs that subdivide into 3-3-3-3-3.

Basic Triangle Patterns:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.