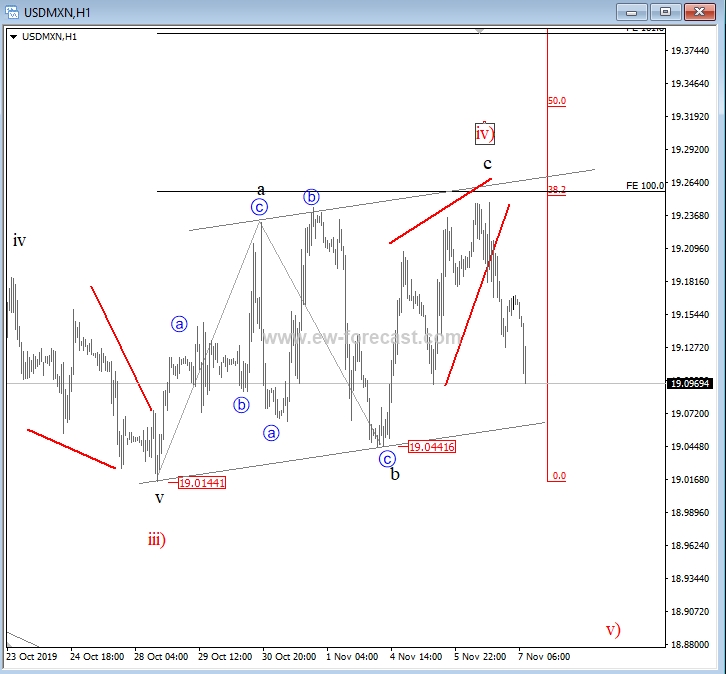

USD/MXN is breaking firmly below the lower Elliott Wave ending diagonal line, which now suggests a completed bigger flat correction within the fourth wave of a downtrend. That said, be aware of further weakness, especially once a minor retracement pops up, possibly around the 19.05/19.07 area.

USDMXN, 1h

An ending diagonal is a special type of pattern that occurs at times when the preceding move has gone too far too fast, as Elliott put it. A very small percentage of ending diagonals appear in the C wave position of A-B-C formations. In double or triple threes, they appear only as the final “C” wave. In all cases, they are found at the termination points of larger patterns, indicating exhaustion of the larger movement.

- Structure is 3-3-3-3-3

- A wedge-shape within two converging lines

- Aave 4 must trade into a territory of a wave 1

- Appears primarily in the fifth wave position, in the C wave position of A-B-C and in double or triple threes as the final “C” wave

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI