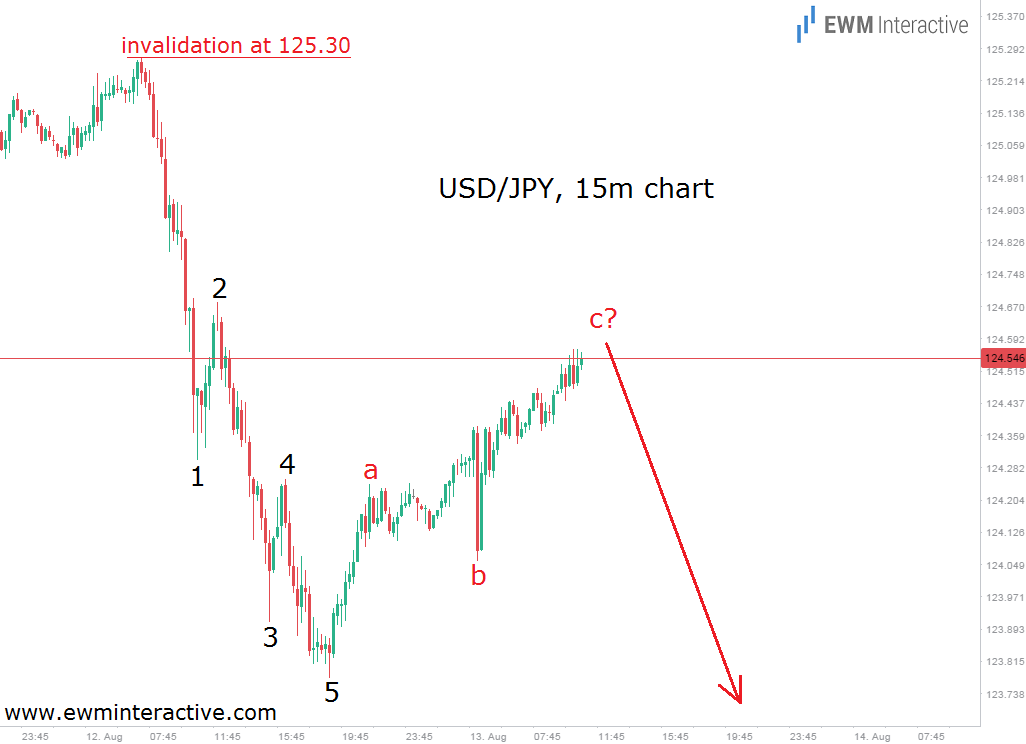

A little over a week ago, on August 13, we spotted a five-wave impulse to the downside, followed by a three-wave recovery on the 15-minute chart of USD/JPY. According to the Elliott Wave Principle, the pair was supposed to head south again. The next chart was published in “USD/JPY Sends A Bearish Message”, where we warned you to “prepare for lower USD/JPY rates”.

Of course, the corrective recovery could extend both in terms of price and time. That is why the theory provides a specific place for the protective stop, so we do not have to think about it all the time. Fortunately, USD/JPY did not go much higher.

When the forecast was made, the pair was trading above 124.50. Today, it fell to 122.80. A great example of the Elliott Wave principle’s accuracy, even on the smallest degrees of trend. From now on, the bears seem to be in charge, so the decline is likely to continue.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.