When you have eliminated the impossible, whatever remains, however improbable, must be the truth, Sherlock Holmes in The Sign of the Four (Doubleday p. 111)

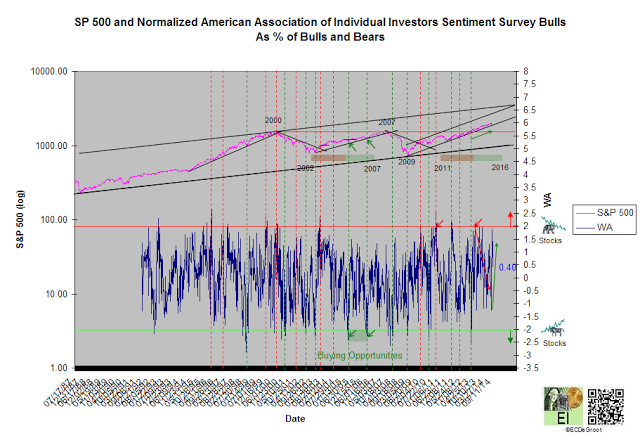

Weighted investor sentiment toward stocks (WA) fell to 0.4 as stocks resumed building cause near their all-time highs (chart). The oscillation of sentiment between concentrated optimism and pessimism suggests plenty of euphoria-based headlines in the coming months.

These bouts of concentrated optimism, a growing supply/demand imbalances and misinterpreted by most, setup trend changes. For instance, when the majority, driven by a tide of optimism toward stocks, becomes a big holder, who's left to buy other than the minority? Clearly, the minority's demand can't handle the majority's supply when the majority-led herd is inevitably spooked.

Today's well-publicized flash crashes are driven by supply/demand imbalances.The media often explains them as manipulation or some other harebrained conspiracies that includes 'fat-finger' theories. These 'sexy' explanations tend to generate more clicks than a massive price decline was required to clear the supply/demand imbalance.

Normalized sentiment survey (below) and equity diffusion charts which includes volatility analysis measure supply/demand imbalances. The latter, based on the movement of leverage rather than surveying opinion, is superior.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.