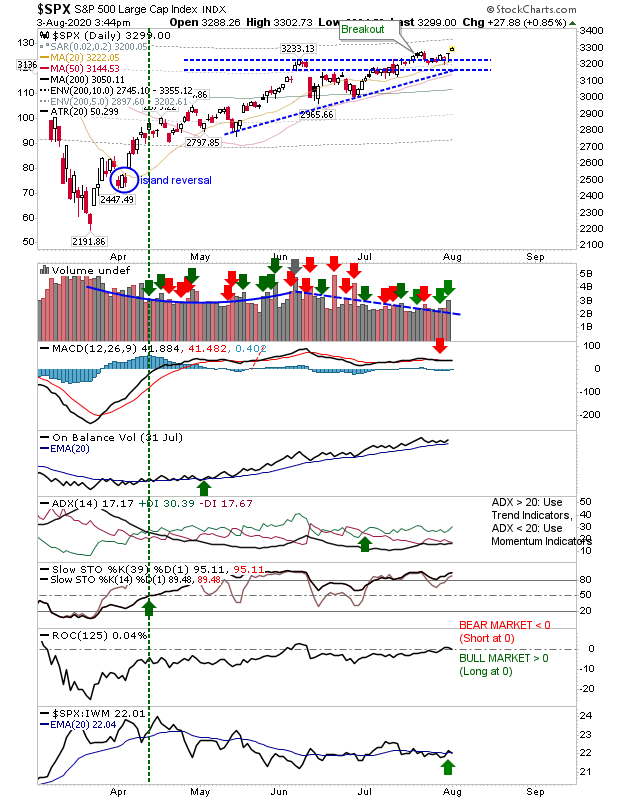

It wasn't a major move but buyers were able to push new highs yesterday, nicking breakouts for the S&P and NASDAQ, but not yet the Russell 2000. I would like to see more volume with the move and ideally, a large white candlestick.

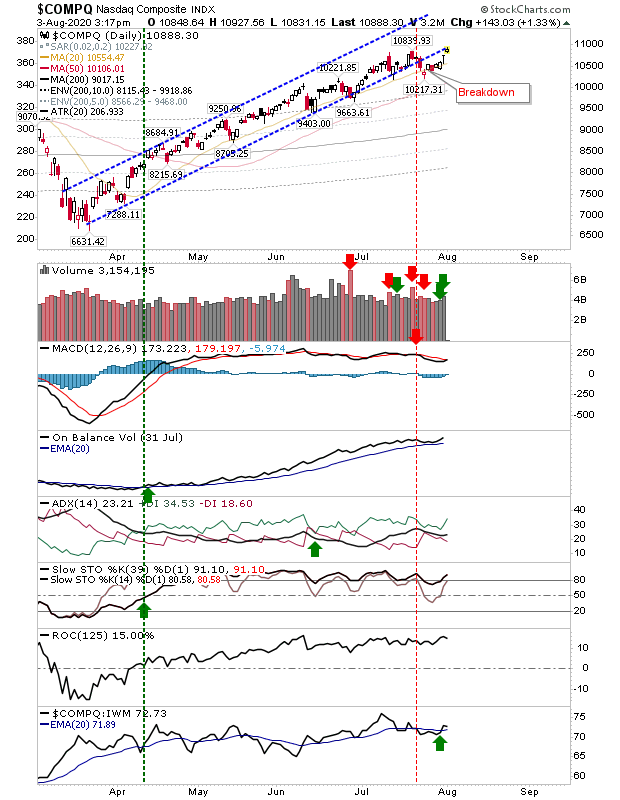

The NASDAQ rallied to former channel support, now resistance. The technical picture has stayed positive even when the rally moved outside of its rising channel. Aggressive players could look for a short.

The S&P has a similar set-up and technical picture as the NASDAQ. Good technical strength but the breakout lacked oomph.

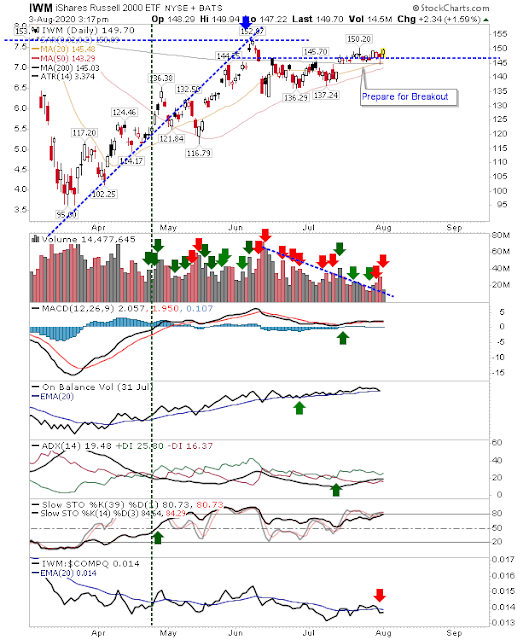

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) is the index in greatest need of a breakout and yesterday's buying was decent, but trading volume was light and the index is underperforming its peers. Traders could a long position and put the stop below Friday's low (from the 'hammer').

Today, look for some follow through. Indices need to put some distance from support to encourage momentum trader participation. The market is drifting with breadth metrics building bearish divergences.