Asia stocks rise past Trump tariff threat, Australia dips after RBA holds

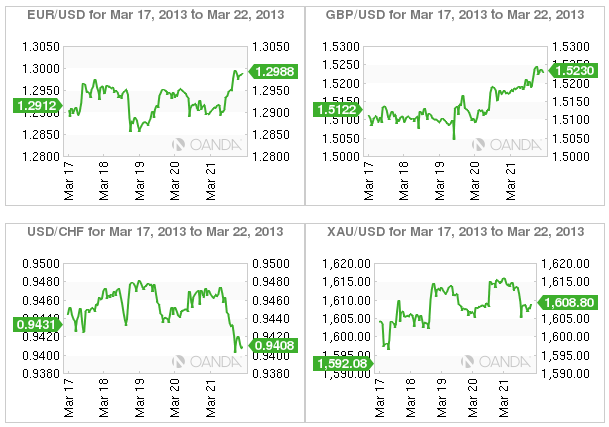

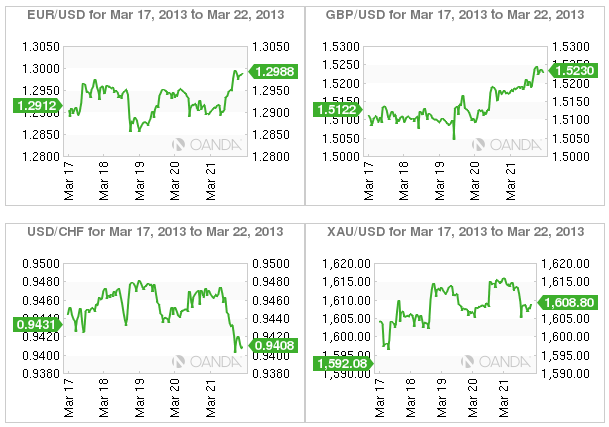

Despite concerns about Cyprus and an unexpected drop in this month’s German business confidence numbers, the 17-member single currency is rounding off the week trading higher against most of its major partners. Many participants still expect the ECB to perform another Houdini act. Capital Markets remain composed; most likely due to the fact that investors have gotten used to the last minute Euro-solutions. They are clinging onto hope that Cyprus will get a deal done over the next three days.

In a worst-case scenario – Cyprus having to leave the eurozone – some investors are holding on to the belief that the ‘buck’ stops with the island country, and no widespread contagion will actually occur. While traders are taking profit on the short EUR positions ahead of the weekend, they are also selling their long winning dollar positions accumulated during this quarter. If by Monday and things do actually go “pear-shaped” for the market, any EUR weakness may only be brief as the ECB will be quick to react to calm the markets through their OMT or the ELA programs.

In a worst-case scenario – Cyprus having to leave the eurozone – some investors are holding on to the belief that the ‘buck’ stops with the island country, and no widespread contagion will actually occur. While traders are taking profit on the short EUR positions ahead of the weekend, they are also selling their long winning dollar positions accumulated during this quarter. If by Monday and things do actually go “pear-shaped” for the market, any EUR weakness may only be brief as the ECB will be quick to react to calm the markets through their OMT or the ELA programs.

- German Ifo Sentiment Index Falls as Crisis returns to Europe

- Europe Considering Closing Cyprus Banks and Asset Freeze

- EU Bailout Ultimatum Leads to Possible Cyprus Euro Exit

- Turkey May Block Natural Gas for Cyprus Bailout Negotiations

- Cyprus may enact new laws to prevent bank runs

- Russia and Cyprus Discuss Banking and Natural Gas Deals

- The UK Budget Doesn’t Help the Pound

- Cyprus Bank Closure Extended to 26 Mar as Solutions Sought

- Portugal FinMin Recovery will Take Decades

- IMF Lagarde Apartment Searched for her role in 1997 Case

- Euro Drifts Toward 4-Month Low Below 1.29

- Cyprus Rejects Bailout Tax on Deposits

- French Finance Minister EU Cannot Lend Cyprus more than 10 billion

- Europe Car Market Shrinks 10 percent in February

- Vote on Bailout Levy Might be Postponed as Official hope to Modify to Avoid Defeat

- Merkel Bows to Public Discontent Considers Capping Executive Pay

- German ZEW Increases in March

- Draghi and Cyprus Not Seeing Eye to Eye

- Cyprus Parliament Unlikely to Pass Levy Vote

- EU wants 5.8 Bln From Cyprus no matter what

- Cyprus Bailout a Reality Check

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

WEEK AHEAD :- USD Fed’s Bernanke Speech

- USD Durable Goods Orders

- USD Consumer Confidence

- GBP Gross Domestic Product

- CAD Bank of Canada Consumer Price Index Core

- EUR Unemployment Change

- USD Gross Domestic Product

- USD Reuters/Michigan Consumer Sentiment Index

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.