As part of Operation Twist, the Fed was taking tremendous amounts of duration out of the market. In effect the average duration of outstanding fixed income products in the market was lowered by their action. The idea was to create a shortage of high duration product, thus lowering long-term rates.

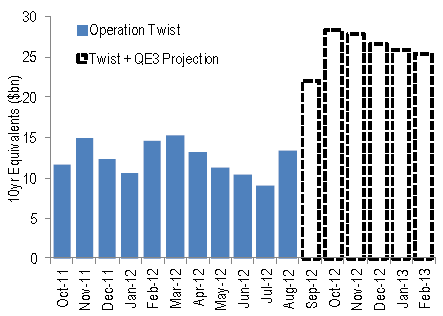

By converting bond purchases and sales into 10-year equivalents (duration adjusted) one can measure how much "effective" 10-year notes have been taken out of the system. With Twist continuing on and agency purchases commencing shortly, this process is going to accelerate.

Some are asking - so what? Who cares if the market's overall duration is shortened? The answer is that ultimately it is the institutional investors such as corporate and state pensions who will get hurt the most by this process. These investors have long-term liabilities and will now be increasingly struggling with the so-called "duration mismatch."

They also have a return hurdle. That allows corporations (even highly leveraged ones) to issue longer dated paper and force institutions to accept ridiculously low yields for the credit risk taken (see discussion). And pensions' portfolios stuffed with higher risk paper should be everyone's concern.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI