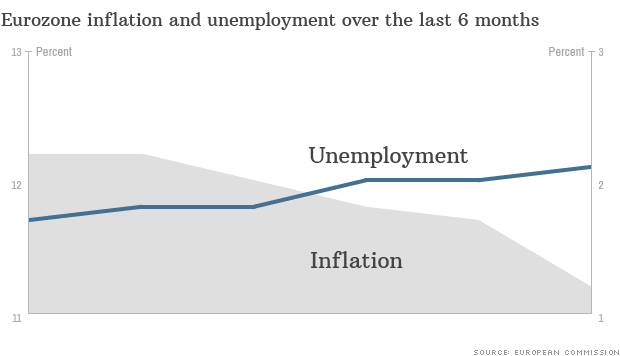

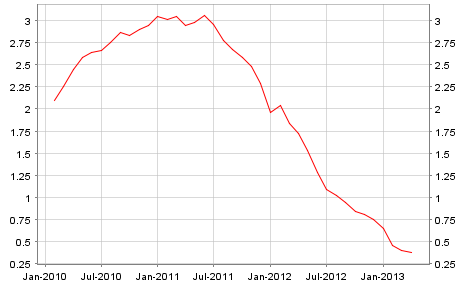

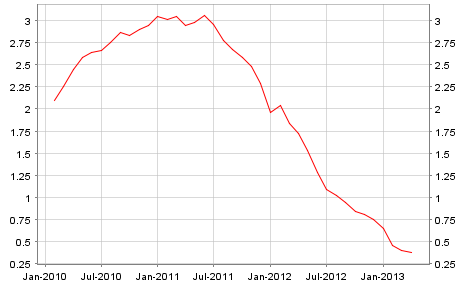

It seems as if the ECB will have no choice but to ease monetary policy, and possibly prepare for more drastic actions. The eurozone is facing a growing risk of deflation - similar to Japan. Once the inflation rate in Japan fell below 1%, the external shock of the Asian currency crisis (late 90s) sent Japan into a deflationary spiral, which the nation is still dealing with today. The eurozone may end up facing a similar scenario.

Danske Bank: "...Europe is heading into a deflationary scenario if they don’t do anything to boost the money supply. This already looks very similar to what happened in Japan in 1996 and 1997.”

Growth in consumer lending has come to a crawl as bank deleveraging continues. With retail credit growth curtailed, corporations have no pricing power. Signs of deflationary pressures are already in place.

Reuters: EU leaders are already trying to shift away from the budget cuts that have dominated the response to the debt crisis since 2009. The data will raise the specter of deflation, as companies slash prices to entice shoppers.

Like Japan, the eurozone may face rising public sector debt as austerity is put on the back burner. In fact, many Europeans now blame the austerity drive by Germany for the deflationary risks the region now faces.

Business Spectator: Eurozone divisions over austerity policies championed by Germany have deepened as Italy's new government joined France in demanding a change of direction for the crisis-hit bloc.

Italy's new centre-left Prime Minister Enrico Letta told parliament on Monday that the country was "dying from austerity alone", and France voiced optimism that the political tide was turning in favour of critics of austerity.

"In terms of growth policies, Francois Hollande will now have a stronger voice and be less isolated in Europe," France's minister for Europe, Thierry Repentin, told AFP.

Letta's direct challenge to the tough belt-tightening that Germany and its allies have advocated as the answer to the single currency zone's debt crisis, follows criticism of the eurozone's direction from the International Monetary Fund.

Whatever the case, the ECB will have to act in order to avoid the dangers of a deflationary spiral, which could take the Eurozone years (or even decades) to exit. FT lists Draghi's possible actions this week, representing a fairly limited set of choices (rate cut, forward guidance, easing collateral requirements for banks to borrow from the Eurosystem, and outright purchases of debt linked to "small and medium sized companies"). Something will need to happen to prevent the eurozone from looking increasingly more like Japan.

Danske Bank: "...Europe is heading into a deflationary scenario if they don’t do anything to boost the money supply. This already looks very similar to what happened in Japan in 1996 and 1997.”

Growth in consumer lending has come to a crawl as bank deleveraging continues. With retail credit growth curtailed, corporations have no pricing power. Signs of deflationary pressures are already in place.

Reuters: EU leaders are already trying to shift away from the budget cuts that have dominated the response to the debt crisis since 2009. The data will raise the specter of deflation, as companies slash prices to entice shoppers.

Like Japan, the eurozone may face rising public sector debt as austerity is put on the back burner. In fact, many Europeans now blame the austerity drive by Germany for the deflationary risks the region now faces.

Business Spectator: Eurozone divisions over austerity policies championed by Germany have deepened as Italy's new government joined France in demanding a change of direction for the crisis-hit bloc.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Italy's new centre-left Prime Minister Enrico Letta told parliament on Monday that the country was "dying from austerity alone", and France voiced optimism that the political tide was turning in favour of critics of austerity.

"In terms of growth policies, Francois Hollande will now have a stronger voice and be less isolated in Europe," France's minister for Europe, Thierry Repentin, told AFP.

Letta's direct challenge to the tough belt-tightening that Germany and its allies have advocated as the answer to the single currency zone's debt crisis, follows criticism of the eurozone's direction from the International Monetary Fund.

Whatever the case, the ECB will have to act in order to avoid the dangers of a deflationary spiral, which could take the Eurozone years (or even decades) to exit. FT lists Draghi's possible actions this week, representing a fairly limited set of choices (rate cut, forward guidance, easing collateral requirements for banks to borrow from the Eurosystem, and outright purchases of debt linked to "small and medium sized companies"). Something will need to happen to prevent the eurozone from looking increasingly more like Japan.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI