It would be impossible to be more dovish than the ECB were yesterday without any actual amendment to monetary policy. Rates remained as they were with no additional asset purchases or extreaordinary policies being enacted; they must be only round the corner, however. Mario Draghi’s press conference told us of a unanimity to the European Central Bank’s Executive Council that we have not seen since the opening days of the global financial crisis. Unfortunately, the unanimity does not come with a policy recommendation, but instead a commitment to do nothing but wait and see, and generally vacillate. The ECB President said that the board members were unanimous on the need for unconventional tools in order to eliminate the threats of deflation in the Eurozone.

The exact make-up and construction of these unconventional tools are up in the air for now. In essence, this press conference merely mirrored previous pronouncements but with the volume turned up. We were told of a need for urgent action, just like before, a need for new tools, just like before, and a promise that the ECB would work tirelessly to protect the Eurozone economy, just like before.

The ECB Chief also pointedly made sure to emphasise a desire for a lower euro, given its impact on the disinflation that is occurring. News from Germany has been poor in recent weeks and we must wonder how much of this is due to a weakened export sector as a result of a EUR/USD rate close to 1.40. Italy, Spain and France are unable to deal at those levels either and a continued strength of the single currency will only increase the pressure on these economies.

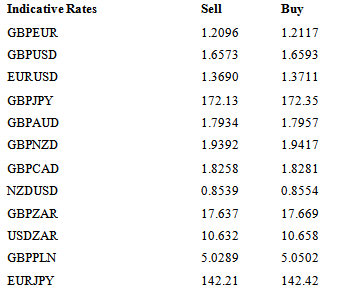

Thankfully, the euro took a hit yesterday against its crosses and pressure will likely continue should we see a strong payrolls announcement from the United States this afternoon. Yesterday’s US data was markedly mixed, a lot more than we had expected. The ISM from the non-manufacturing sector strengthened to 53.1, slightly below expectations, but strength in new orders and, more importantly, in employment allowed the USD to extend yesterday’s gains. Jobless claims slipped back above the 320k mark; a disappointment after last week’s 4-month low.

I am struggling to remember a payrolls announcement that has had such a bullish vibe around it as today’s. The consensus remains at 200,000 jobs this morning, but I would suspect most are secretly looking, and certainly hoping, that we see something 20-30% bigger come 13.30 this afternoon. Anything towards 250,000 will see a good charge lower on equities and Treasuries but with the USD strengthening across the board. Our estimate is for 235,000 and broad USD strength.

PMIs from the Eurozone and the UK this morning were mixed. Data from Italy and Germany both disappointed with the former dipping back into contractionary territory after a strong positive print in February. Germany’s was revised from 54.0 to 53.0; a large revision from the ‘flash’ estimate published last week. Spain and France both saw levels of growth, which are only really acceptable as a result of their relative scarcity.

News from the services sector in the UK was disappointed this morning with a PMI reading of 57.6 from 58.2 previously. We have seen a recent softening of UK data in so much that growth is strong and no longer extreme. The slowing will take some steam out of expectations for the future and, more importantly, will slow the rate of job creation in the UK’s most important industry. March was the 15th consecutive month of gains in service sector employment and we would expect this to slow as long as wage rises remain poor.

Overall, this is good news for us who think that rate expectations around the UK economy have got too far ahead of themselves and sterling is too high at the moment. Falling price pressure will allow the Bank of England to move away from tempering calls for rate hikes in the near-term and sterling should slip from its recent highs as a result.

Combining the three PMIs – manufacturing, construction and services – I forecast GDP in Q1 to be 0.7%

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI