- BoE non-event risk in pipeline

- Draghi’s Headaches Persist

- What’s the ECB’s minimum requirement?

- EUR’s expectations if disappointed

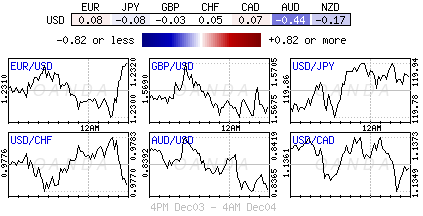

The threat of global central bank action is managing to keep the various assets classes on their toes. Whether it’s the Central Bank of Russia (the threat of tighter monetary policy next week), the Peoples Bank of China (easing of monetary policy sooner rather than later), the Bank of England or the impending ECB rate and press conference announcement in a matter of hours. Both traders and investors remain wary of unforeseen actions, or lack off, to initiate their early year-end exit strategy before the holiday “funny” price action begins in earnest. Today’s ECB meet is really the next to last monetary event risk of the year. The FOMC is expected to go through the obligatory motions in their two-day meet later this month (December 16/17), while leaving the tougher announcements and clues for the new calendar year.

BoE the expected sideshow

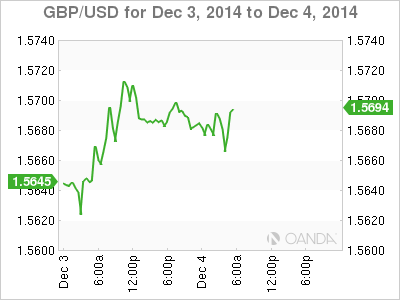

The BoE’s rate announcement is expected to be a non-event risk. Many are forecasting that GBP (£1.5671) will be unfazed by the announcement. The main focus lies across the English Channel with the ECB, and in particular Draghi’s press conference after the obligatory rate announcement. The market will be looking for clues to solidify their EUR bearish convictions. The ECB president has become a ‘dab hand’ in saying a lot without saying much.

The majority of the BoE’s MPC are in no rush to raise U.K interest rates, and reason enough why the market expects Governor Carney to keep the bank rate at +0.5%. Data this morning indicated that the U.K housing market slowed further in November. The Halifax HPI, in the three-months to November, rose by +0.7% from +0.9% the previous month. This is the fourth consecutive drop month-over-month since growth peaked last July. Carney and his team have been very transparent in forward guidance, and this despite the dissent within the MPC. The market expects to be further briefed before there are any changes by the BoE, hence the anticipated sideshows.

Draghi’s Headaches Persist

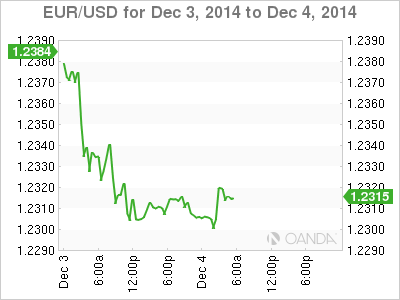

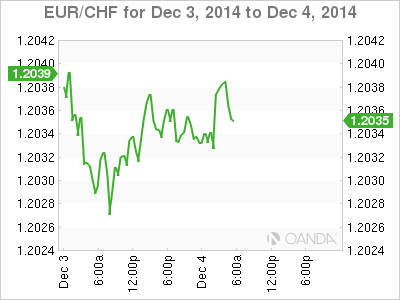

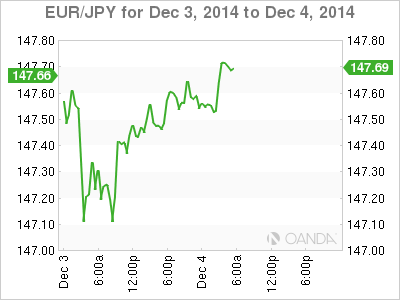

The troubles at the ECB are far more delicate than most central banks can relate too, and every twitch, tick and statement is torn apart by capital markets in seeking “their own” truth. Currently, the 18-member single unit continues to waddle within sight of its fresh two-year low outright (€1.2296) ahead of today ECB’s monthly meeting, with investor expectations of further easing running “higher than normal.”

Nevertheless, Draghi and company are expected to leave rates on hold, but a growing consensus expects the ECB President to indicate that officials are moving closer to launching a wider range program of asset purchases or QE. Regional eurozone bond yields have already managed to print new record low this week in anticipation of looser monetary policy. Disappointing mid-week Euro business activity data prints has egged them on. With euro economic recovery nearly non-existent, coupled with the problems of falling inflation, or the ongoing threat of deflation, has almost convinced everyone that the ECB’s back is against the wall, and that they need to be “proactive,” whether by word or action. At some stage, sooner or later, the ECB will implement further expansionary measures. However, consensus tells us its not today.

What’s the ECB’s Minimum Requirement?

Investors are betting that a QE program or lookalike will continue to support regional bonds and equities, but many investors expect that the ECB will wait until next year before broadening its solution package. The danger is that the market may experience a quick deep asset price pullback if Draghi and company manage to be at least “less assertive” in their convictions. If that is the case, the ECB will lose a ton of street credibility in one single stroke.

The minimum requirement for Draghi today is to sound as “dovish” as he can while not actually announcing any more monetary easing – and make it sound convincing. The ECB all along has indicated that they really want to wait and see the take-up at the mid-December TLTRO (long-term refinancing operation). Further ECB action will become much clearer if current measures and programs are not good enough to increase the ECB’s balance sheet. Failure will convince the ECB to act fast – perhaps buy corporate bonds in early January, 2015 and implement sovereign QE sooner than they had been anticipating (end of Q1 or early Q2, 2015).

EUR’s expectations

The EUR currency bears own the upper hand as the market plays out the final few-weeks of this year. The single unit has managed to hit fresh 27-month low as it tests below €1.2300 ahead Draghi’s highly touted press conference. Although the odds for fully blown QE have risen amid the weak growth outlook and the prospect of persistently low inflation, dealers note that Draghi needs to provide a very strong easing message in order to keep EUR/USD offered at this time.

From a technical perspective, the next key EUR low is at €1.2288 (June 2012) and a break there managed to produce another two-cent drop to €1.2042 rather quickly. If the ECB were to add stimulus today the market will be expecting this as a minimum. Nevertheless, the current market bar for disappointment seems to be rather low. Upsetting the bear positions should be capable of triggering some conveniently “large” stop losses just above the option protected €1.2400 handle. Any funny business from the ECB and bears will be trying to shut the shop door to end the year despite U.S payrolls being on the horizon.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.