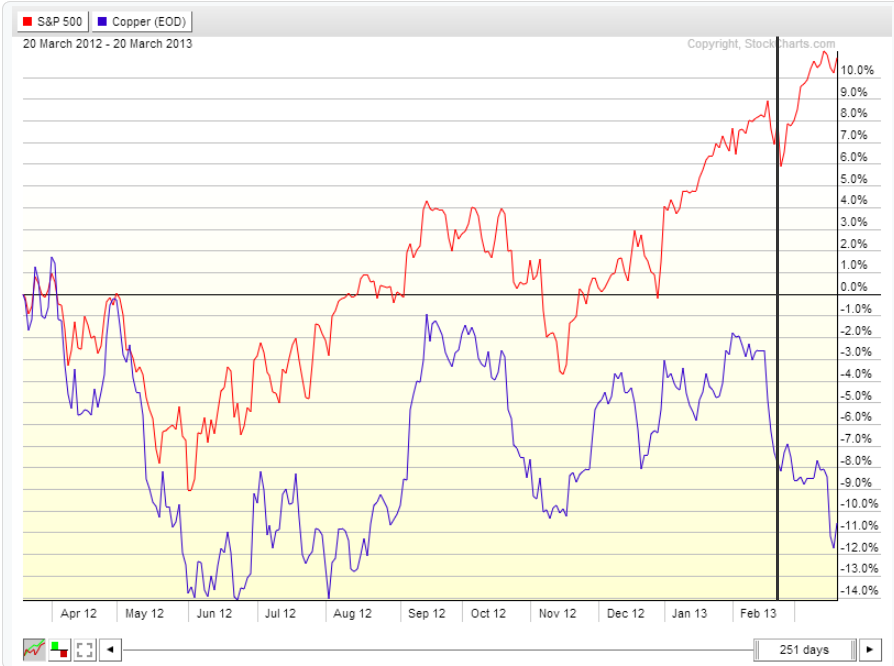

Copper (JJC) has long been said to have a PhD in economics. That is because the price of Copper has been highly correlated to the US stock markets. The Performance Chart below shows how Copper has moved with the S&P 500 (SPY) over the last year. A very tight correlation, until you hit the dark green line in mid February. At that point it flips nearly instantly to being inversely correlated. This has led to many experts expecting that the US Market is probably topping and about to reverse.

That is, of course, one possibility for how a strong correlation mean reverts. The other is what happened between July and September of 2012, where Copper dipped lower and then rocketed back higher to catch up and reaffirm to the strong correlation.

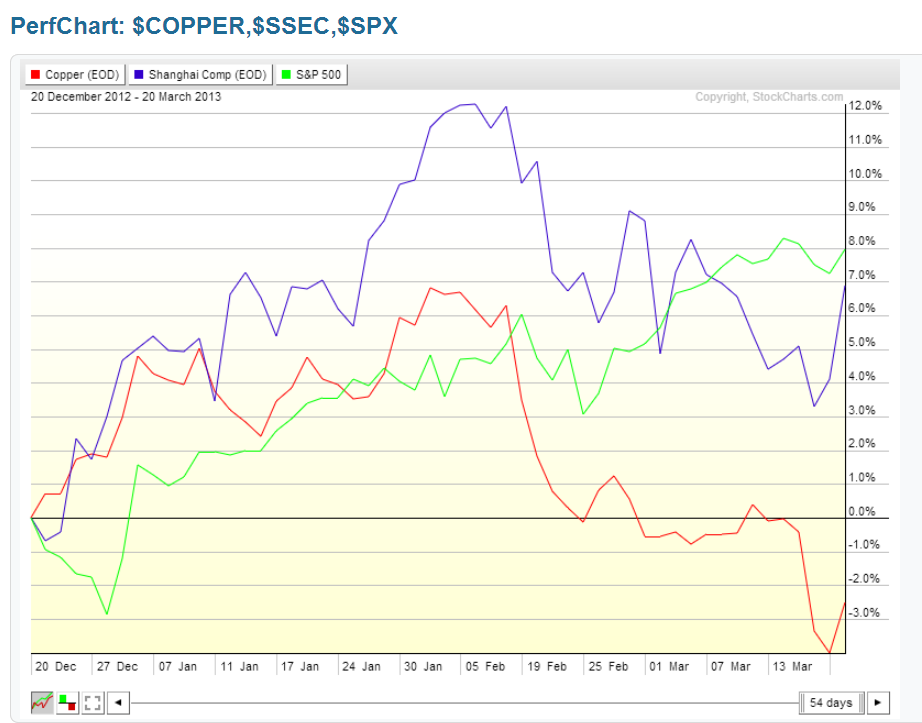

Another possibility is that the correlation has been broken. This can happen between assets as I pointed out last week in the relationship between the US Dollar and the S&P 500 here. In this case, what looks like a breakdown in the correlation between Copper and the S&P 500 in February may have been masked by a strong correlation between Copper and the Shanghai Composite (SSEC, FXI) that began in early December and is continuing.

The Performance Chart above with all three clearly shows a strong correlation between the Shanghai Composite and Copper over the last 4 months. So did doctor Copper just take some time off to study Madarin?

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.