What’s wrong with the housing market?

Some believe in the basic premise of the Dow Theory, which is to say that it's 'good to see strength in the Dow Jones Industrials, Utilities and Transports indices at the same time.'

But the reverse is true as well -- if all three are weak, it doesn’t bode well for the broad markets.

Today we take a look at the Dow Jones Transports Index (DJT) and how it's facing breakout levels.

For most of the year, the Transports index has been weak, as it started heading lower, before the broad market did. This divergence had many concerned that a large decline in the markets was in store.

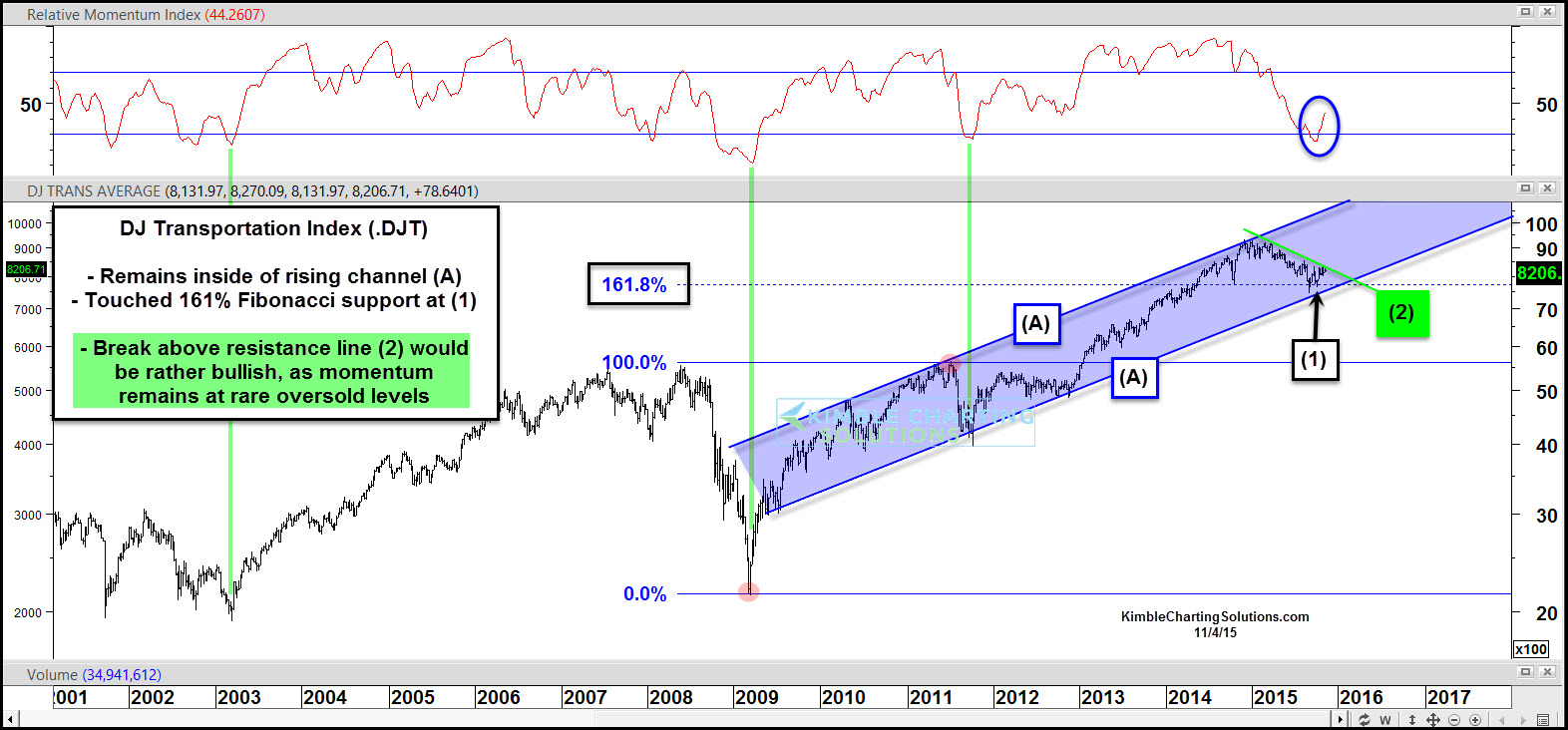

As you can see, the Transports index has remained inside of rising channel (A) over the past 5 years. The decline this year did nothing more than take the index down to dual support, which was its 161% Fibonacci extension level and rising channel (A) at (1). The decline in this index looks to have found dual support to be important.

Now the Transports are testing breakout resistance line (2). Momentum is oversold, hitting levels seldom seen over the past 15 years. If Transports can breakout here, momentum would suggest it could rally for a while, since it's so oversold.

If Transports can breakout above (2), it would send a bullish message to the broader markets.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI