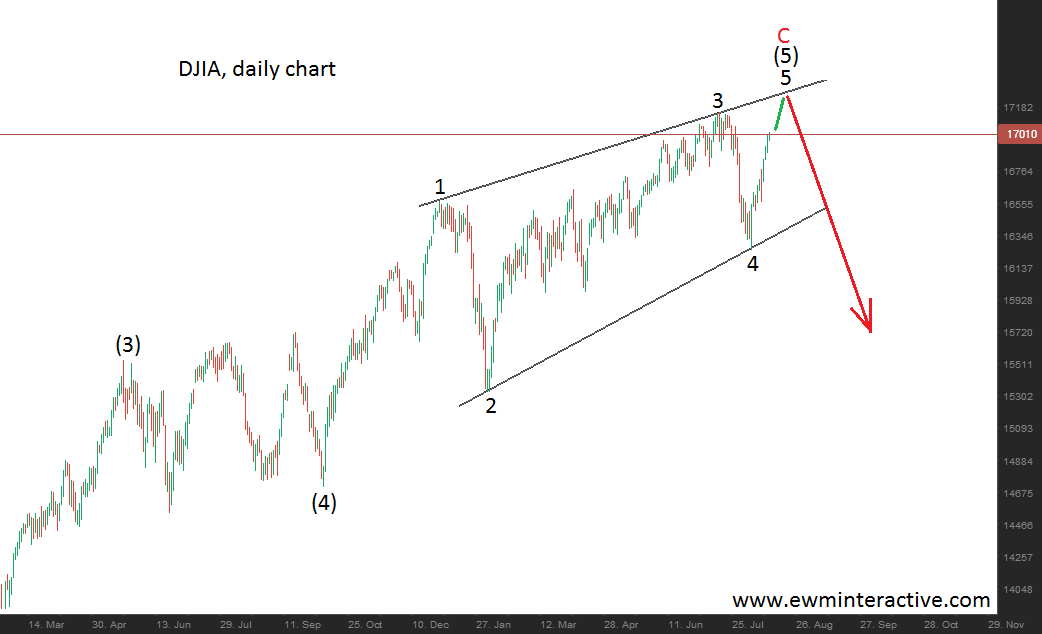

The last time we expressed our concerns about the Dow Jones Industrial Average was in “Dow Above 17 000 Again, But…” . In that material we warned you about an ending diagonal forming on the daily chart. To those, who use the Elliott Wave Principle, this pattern signals for a violent reversal ahead. You can see the previous diagonal in the Dow on the chart below.

As visible, we were expecting an unpleasant surprise for the bulls, once wave 5 of the diagonal was over:

“Another new high should be expected, probably around 17 300, but then the bears should take control of the situation.”

What happened next terrified a lot of people. In less than a month the Dow Jones Industrials fell by more than 1500 points, from 17 362 to 15 850. Today, DJIA is trading close to 18 000 and the scary days seem to be forgotten. However, it looks like the charts are once again trying to warn us for a danger ahead.

It appears there is another ending diagonal, which makes it two in a row. Does this mean we should prepare for the same development? Yes. In fact, the sell-off could be even bigger, because this is a larger degree pattern. The big picture count explains it.

According to the theory, market trends move in five-wave sequences, called impulses. The Dow has been in a strong rally ever since March 2009. But this impressive advance does not have a complete five-wave structure yet. It consists of only three waves, labeled (1)-(2)-(3). If this is the correct count, wave (4) to the downside should be next. Usually, fourth waves retrace back to the zone of the previous fourth wave. If we apply this guideline to the current situation, it turns out there is a good chance for a decline of more than 2300 points in wave (4).