The Dow formed what looks like a long-term “Megaphone” pattern in the late late 1960’s to early 1980’s.

When it took out overhead resistance of the megaphone pattern in the mid 1980’s, it pretty much never looked back.

Last summer, the Dow broke above resistance based upon the 2000 and 2007 highs, which was a positive from a technical point of view.

The decline of late took the Dow below support line (A) and now its kissing it as resistance at (1) above.

Is this pattern scaring people? Yesterday we shared that investors were betting big time on a “Black Swan” event right now.

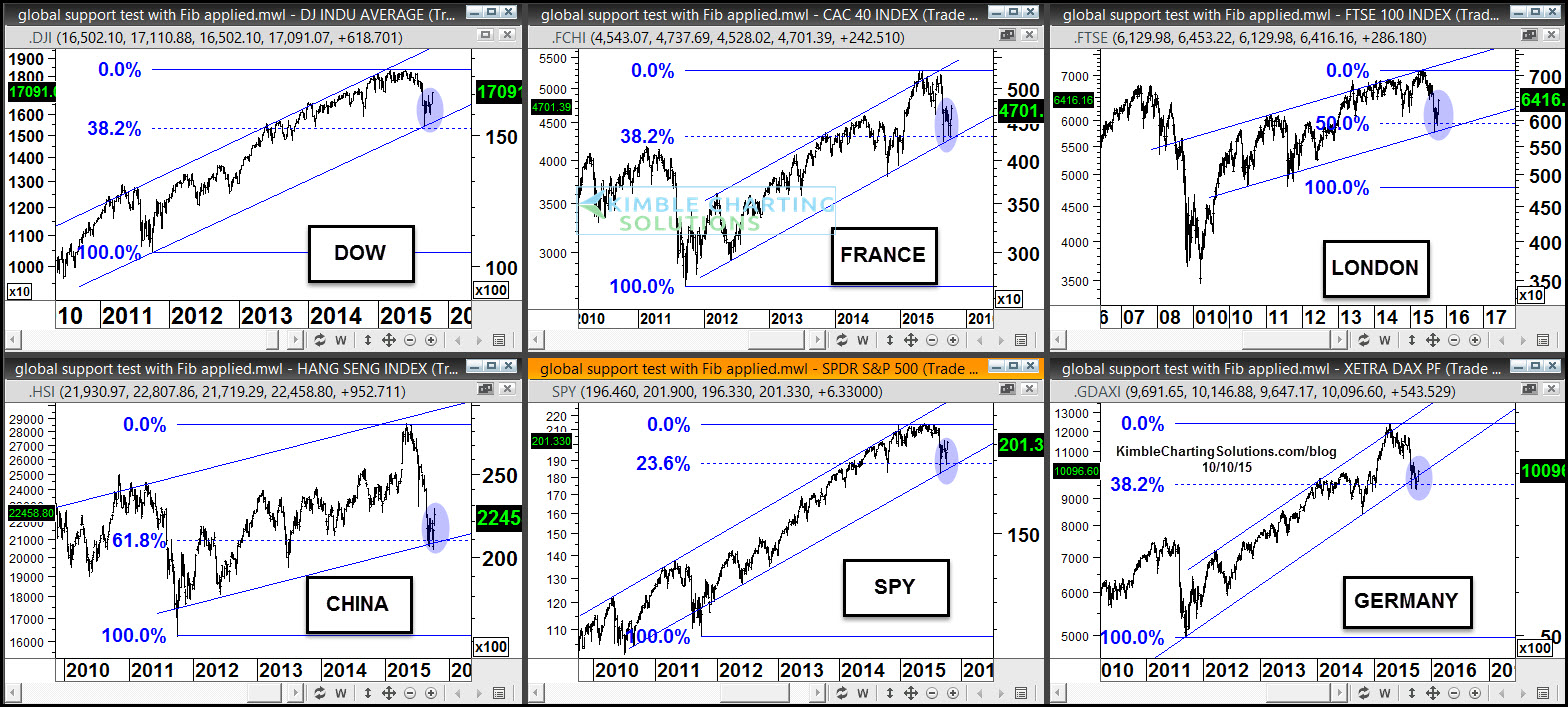

The broad markets remains inside of uniform 5-year rising channels, support remains in play around the world, reflected in the 6-pack below.

The take away from this 6-pack is this….Markets around the world have experienced short-term declines in longer-term rising channels. Each markets decline of late

took it down to 5-year support, where each of these markets created reversal patterns at Fibonacci retracement levels.

I’m not so sure what has options players betting on a “Black Swan” event at this time.

What would have me concerned is this, if the Dow finds the underside of the megaphone pattern to be “mega resistance” and in turn 5-year rising support breaks.

Right now support is support and until it breaks, it would appear option players might be wasting some money on put options, until support gives way.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.