I genuinely admire Morgan Housel. I think he is a brilliant and talented writer. However, he sent out a tweet on Friday that really struck a chord with me.

It’s an innocuous tweet, meant with the best of intentions to leave you with a sense of optimism as you headed into your weekend.

I get it. Really.

As Bob Farrell once quipped:

Bull markets are more fun than bear markets.

Bull markets also “sell” financial products, services, and offerings. Wall Street makes money selling products and services to “Main Street” who makes money with higher prices. Financial media makes money as advertisers market their “wares.” Being bullish also gets views, likes, comments, and shares. Bull markets thrive when “greed” erases the memories of previous “bear market” losses.

As Gordon Gecko said:

Greed is good.

The problem with being “bullish all the time” is that it is also very dangerous.

This is particularly the case in late-stage “bull markets,” where poor investment decisions, and excessive portfolio “risk,” are masked by seemingly ever-rising prices. Previously bad investment ideas, products, and strategies tend to resurface in a different form or package. Investment strategies like “buy and hold” and “dollar cost averaging” become popular even though they are absolutely guaranteed to leave you well short of your financial objectives in the future.

So, what does this have to do with Morgan’s tweet?

It has everything to do with one of my “pet peeves,” and the biggest fallacy pushed by Wall Street today – “compound returns.”

Markets Don’t Compound

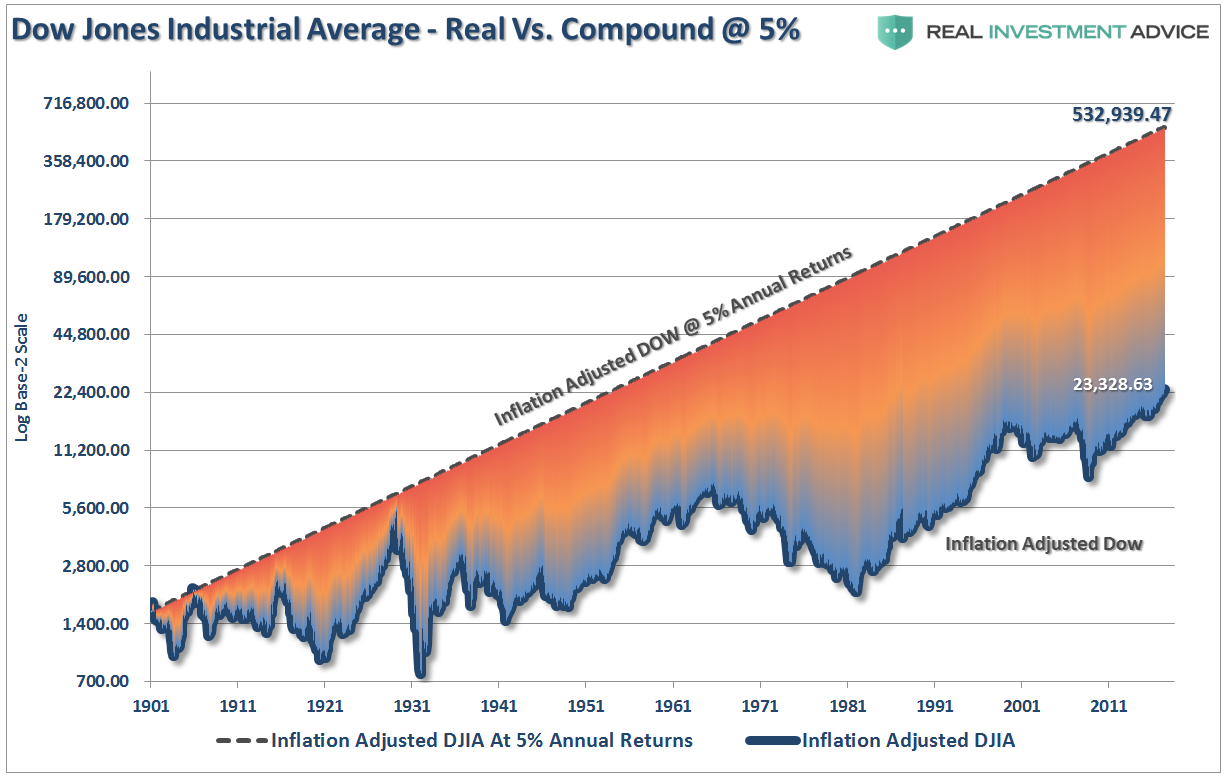

Morgan states that in 30 years, if the Dow grows at just 5% annually, it will hit 500,000. However, if the Dow actually compounded returns at 5%, in the future, as Morgan suggests, it would have done so in the past and would ALREADY be at 500,000.

But it’s not. We are just stuck here at a crappy ole’ 23,000.

There is a huge difference between compound returns and average returns. The historical return of the markets since 1900, including dividends, has averaged a much higher rate of return than just 5% annually. Therefore, the Dow should actually be much closer to 1,000,000 than just 500,000.

But it’s not.

Nope…we are just hanging out way down here at 23,000.

Why? Because crashes matter. This is particularly the case when it comes to your financial goals and investing time horizons.

Think about it this way.

If “buy and hold” investing worked the way that it is preached, then why are the financial statistics of 80% of Americans so poor?

The three biggest factors are:

- Destruction of capital;

- Lack of savings, and;

- Time.

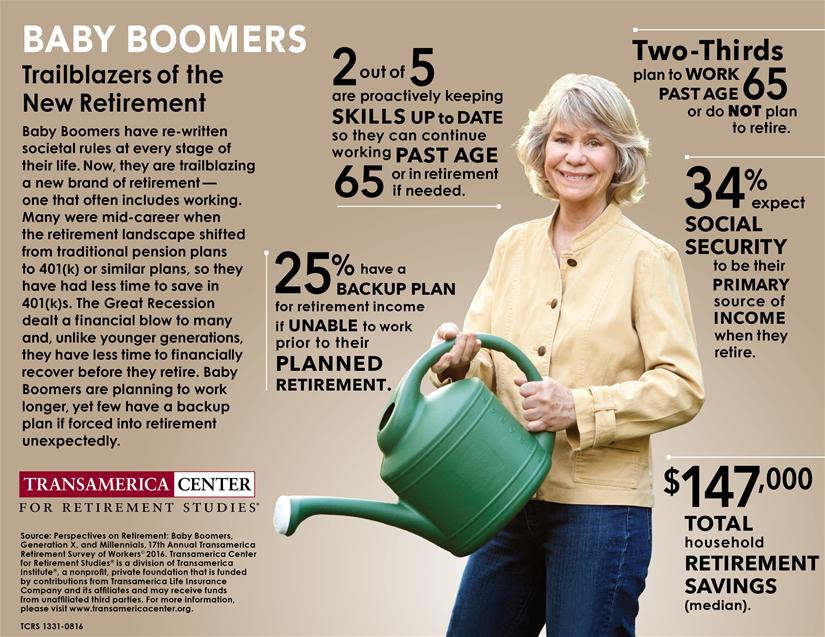

While lost capital gain be regained, the time lost “getting back to even” cannot be. Unfortunately, we don’t live forever and time is our ultimate enemy. After two major bear markets, the majority of “boomers” are simply unprepared financially for retirement.

It is also the reason why we are facing a massive “pension crisis” in the not so distant future as capital destruction, low contribution rates, and over-estimation of returns has led to massive shortfalls to meet required distributions in the future.

Who wouldn’t love a world where everyone just invests some money, the markets rise 6% annually and everyone one’s a winner.

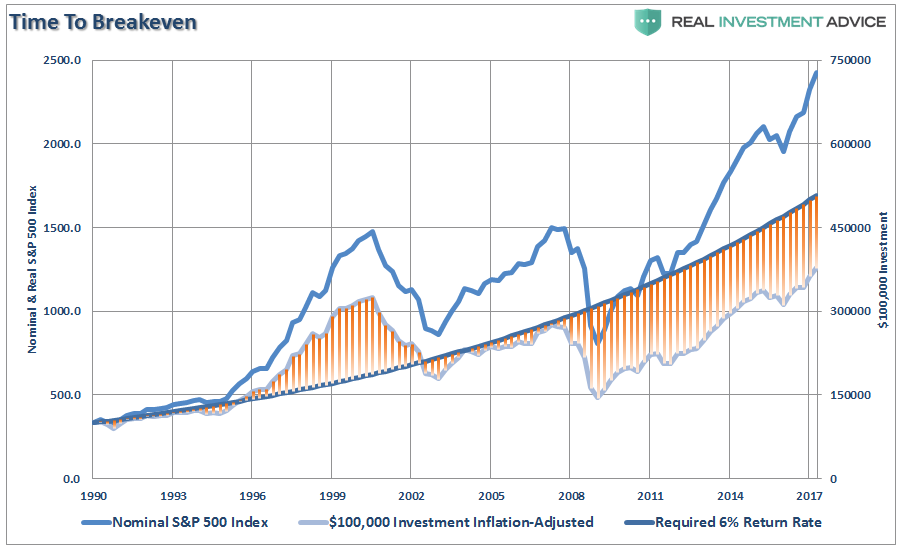

Unfortunately, there is a vast difference between an “index,” which benefits from share buybacks, substitutions, and market capitalization weighting versus a portfolio invested in actual dollars. The chart below shows the S&P 500 index (nominal since that is the way it is primarily discussed) versus the actual, inflation-adjusted value, of a $100,000 investment and compared to the 6% annual return rate promised by Wall Street.

See the problem? People 30 years ago who were hoping to retire, simply can’t. It will likely be the case for individuals today looking to retire 30 years from now.

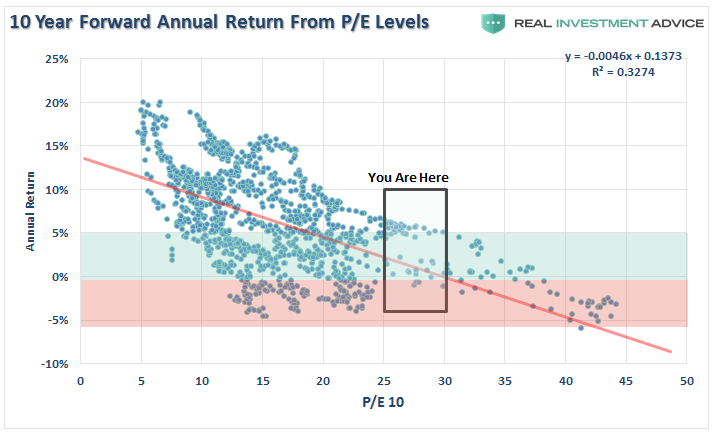

With markets now back to the second highest level of valuations on record, forward returns over the next 10 years are going to be substantially lower than they have been over the past 10 years.

That isn’t being bearish. That is just math.

Dr. John Hussman previously wrote the most salient point on this topic.

Put simply, most apparent ‘opportunities’ to obtain investment returns above zero in conventional assets over the coming decade are based on a misunderstanding of valuations, total returns, and historical yield relationships. At current valuations, virtually everything is priced for a decade of zero.

Throughout history, bull market cycles are only one-half of the “full market” cycle. This is because during every “bull market” cycle the markets, and economy, build up excesses which are “reverted” during the following “bear market.”

As Sir Issac Newton once stated:

What goes up, must come down.

Looking beyond the very short-term overly optimistic view of “this time is different,” the coming unwinding of current speculative extremes will occur with the completion of the current market cycle. As I noted in this past weekend’s missive:

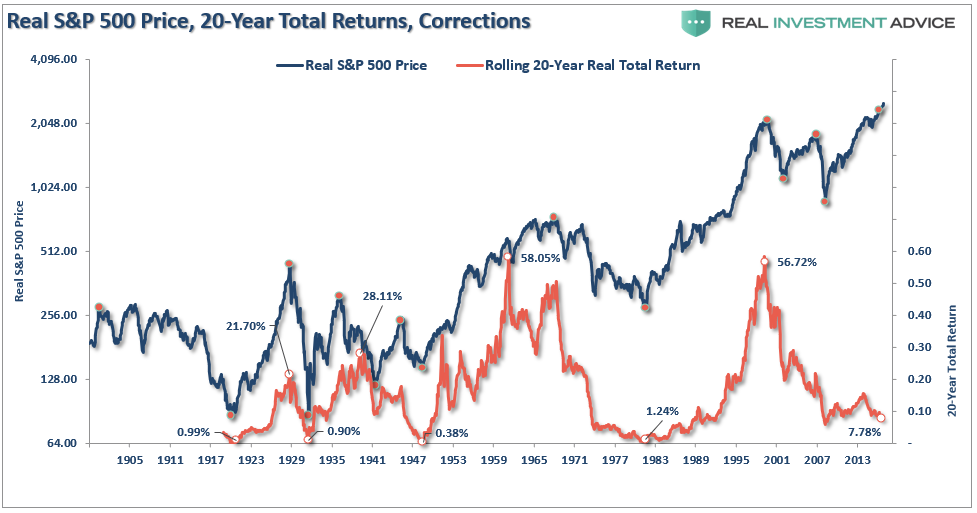

Also, when we look at 20-year trailing returns, there is sufficient historical evidence to suggest total, real returns, will decline towards zero over the next 3-years from 7% annualized currently.

(These are trailing 20-year total real returns, not forward)

Re-read that last sentence again and look closely at the chart above. From current valuation levels, the annualized return on stocks by the end of the current 20-year cycle will be close to 0%. A decline in the next 3-years of only 30%, the average drawdown during a recession, will achieve that goal.

The second-half of this current cycle will begin likely sooner, rather than later. As stated, it is a function of time (length of market cycles), math (valuations) and physics (price deviations for long-term means.)

I am not bullish or bearish.

My job as a portfolio manager is simple; invest money in a manner that creates returns on a short-term basis while reducing the possibility of catastrophic losses over the long-term.

While “bulls have more fun” while markets are rising, both “bulls” and “bears” are owned by the “broken clock” syndrome during the completion of the full-market cycle.

The biggest secret in achieving long-term investment success is not necessarily being “right” during the first half of the cycle, but by not being “wrong” during the second half.

It’s okay to be “always be bullish” with your attitude, just not with your money.