Bitcoin price today: muted at $118k but altcoins soar as House passes new bills

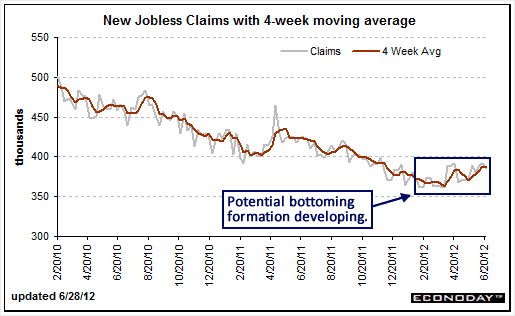

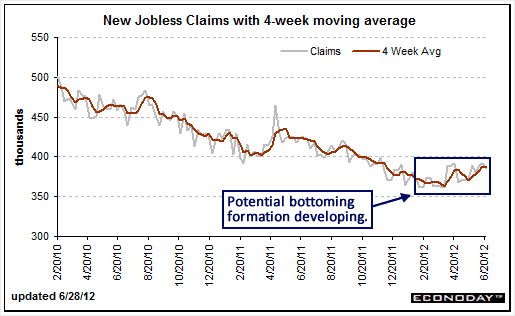

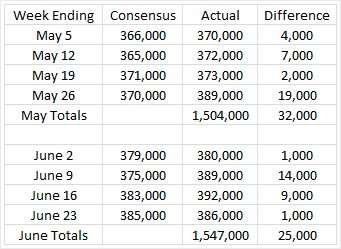

As anticipated in March, economic data have deteriorated meaningfully during the last two months and the likelihood that the U.S. is sliding into a recession continues to increase. On Friday, the Bureau of Labor Statistics (BLS) will issue its June employment report, which is likely to reflect accelerating deterioration in the labor market. Initial unemployment claims have been reported consistently higher than expectations during the last several weeks and a potential bottoming formation is developing. A subsequent headline number above 400,000 would signal the start of a new uptrend and predict additional weakness moving forward.

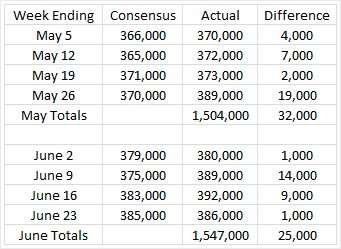

Consensus expectations remain behind the curve with respect to the developing deterioration. In May, the mainstream view expected a headline number of 150,000 jobs created, while the actual number was only 69,000. The current consensus expectation for the June number is 90,000, which would be a slight improvement over May. However, none of the recent economic-survey data have exhibited meaningful improvement in their employment measures. Additionally, initial unemployment claims have increased by 43,000 from May to June, suggesting that the mainstream view may be surprised again.

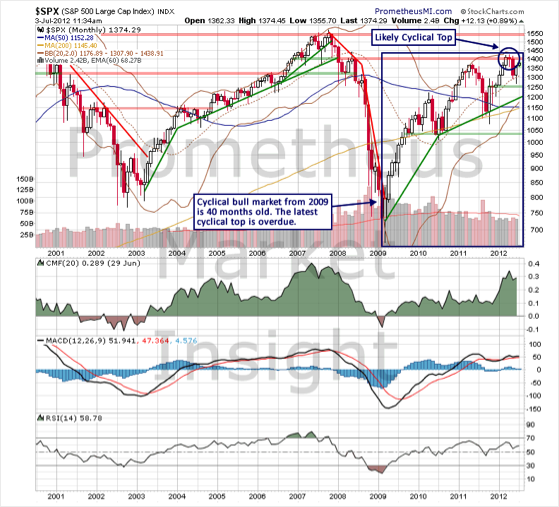

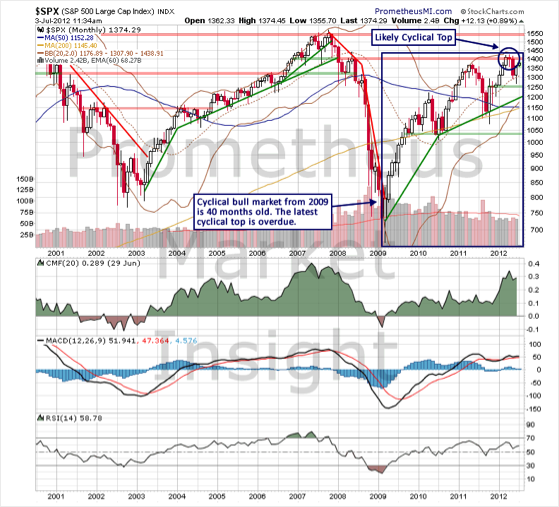

Another disappointing job creation number at or near the zero level, or an outright move into contraction territory, would place substantial pressure on the stock market, which is undergoing an important test with respect to long-term direction. As we noted yesterday, the cyclical bull market from March 2009 is substantially older than the typical uptrend within a secular downtrend, so the latest cyclical top is long overdue and it likely formed in March.

The sharp rebound off the June low has caused a resurgence in bullish sentiment following April's breakdown. However, short-term moves only have meaning when analyzed in the proper context afforded by the bigger picture. Although stocks have rallied more than 8% during the last four weeks, this type of market behavior is common during the formation of cyclical tops. Following the initial breakdown, the market usually experiences a violent oversold reaction before resuming the new downtrend. Another disappointing employment report could be the catalyst that triggers the next reversal, so it will be important to monitor market behavior closely during the next week.

We will identify the key developments as they occur in our daily market forecasts and signal notifications available to subscribers.

Consensus expectations remain behind the curve with respect to the developing deterioration. In May, the mainstream view expected a headline number of 150,000 jobs created, while the actual number was only 69,000. The current consensus expectation for the June number is 90,000, which would be a slight improvement over May. However, none of the recent economic-survey data have exhibited meaningful improvement in their employment measures. Additionally, initial unemployment claims have increased by 43,000 from May to June, suggesting that the mainstream view may be surprised again.

Another disappointing job creation number at or near the zero level, or an outright move into contraction territory, would place substantial pressure on the stock market, which is undergoing an important test with respect to long-term direction. As we noted yesterday, the cyclical bull market from March 2009 is substantially older than the typical uptrend within a secular downtrend, so the latest cyclical top is long overdue and it likely formed in March.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The sharp rebound off the June low has caused a resurgence in bullish sentiment following April's breakdown. However, short-term moves only have meaning when analyzed in the proper context afforded by the bigger picture. Although stocks have rallied more than 8% during the last four weeks, this type of market behavior is common during the formation of cyclical tops. Following the initial breakdown, the market usually experiences a violent oversold reaction before resuming the new downtrend. Another disappointing employment report could be the catalyst that triggers the next reversal, so it will be important to monitor market behavior closely during the next week.

We will identify the key developments as they occur in our daily market forecasts and signal notifications available to subscribers.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI