The S&P 500 started Tuesday with modest losses, rebounded decisively into the green by lunchtime, but ultimately was unable to hold those midday gains and finished flat. While it looked like a lot was going on and it gave the financial press something to talk about, the mistake is reading too much into what is truthfully little more than random noise.

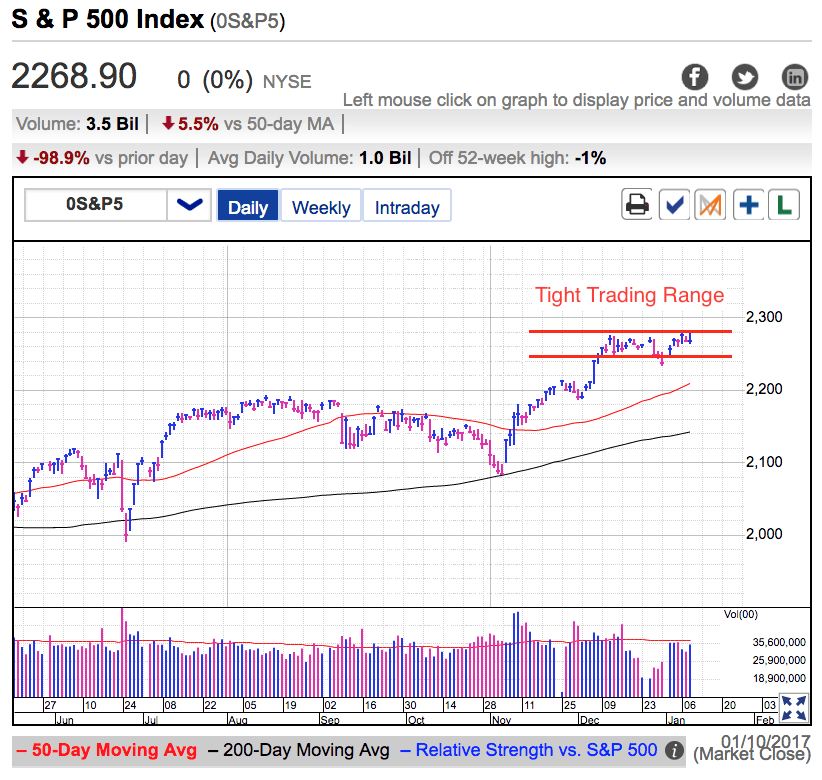

We have been stuck inside a tight trading range since early December. The market only briefly ventured outside of 2,250-2,280 and even that departure lasted little more than a day. If we assume the market is driven by fundamentals, it is hard to fathom four-weeks of alternating bullish and bearish news so perfectly balanced that we danced on this fine line. That’s akin to flipping a quarter twenty-times and having it come up heads every time. Possible, but not likely. Instead of being driven by headlines and fundamentals, this market is responding to the simple laws of supply and demand.

Trump’s surprise win put stock owners in a good mood as they anticipate bullish policies that will drive stocks even higher. When owners are patiently holding for higher prices, supply stays tight and that props up prices. But on the other side, those with cash have been far less convinced. While there was a brief flurry of short covering and breakout buying following the election, further gains have stalled because buyers are scarce near these record highs. No matter what the headlines have been trumpeting over the last several weeks, owners don’t want to sell and those with cash that don’t want to buy. The result is this trading range.

The biggest risk in flat markets is most traders arrive with a bullish or bearish bias. That means they assume every story or price gyration will lead to the next directional move. Bulls rush to buy every apparent breakout and bears pile on the breakdowns. But because there is no substance behind these random moves, each breakout or breakdown fizzles within days and these overactive traders get washed out for a loss when prices reverse. Often the best trade is to not trade and that has definitely been the case recently.

Stocks tumble from unsustainable levels quickly and it is encouraging we’ve held the upper end of the trading range for five-days. Even though yesterday’s intraday price-action was pathetic, the market is acting like it wants to test the psychologically significant 2,300 level. At the same time the Dow will have finally broken 20,000 and once we get these round numbers out of the way, we can finally get on with business. Many traders will use the exuberance around these milestones as an excuse to take profits and we are more likely to stumble from these highs than stage a decisive breakout. Lack of demand continues to be a major obstacle and it is unlikely to be rectified anytime soon.

Assume we will continue trading sideways until something unexpected happens. That means buying weakness and selling strength.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.