Trump says he will sue Wall Street Journal, NewsCorp, over Epstein letter report

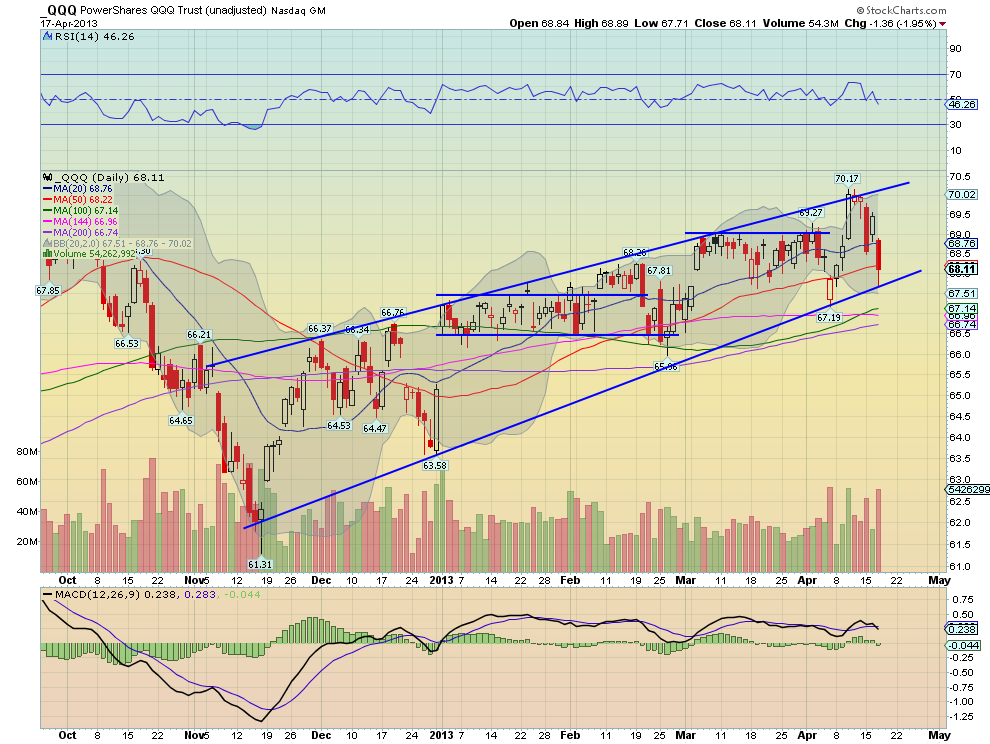

The Nasdaq, represented by the QQQ, has been seen as the laggard during the market's rise through March. And rightly so as the Russell 2000 barreled ahead with the S&P 500 not far behind. The QQQ was the slow plodder higher. From the daily chart below you can see the rising channel that began at the November lows. With Wednesday’s action, touching the bottom rail and then retreating back up to the rising 50-day simple moving average (SMA), it's not time, yet, to throw in the towel on a continued move higher.

Hold On

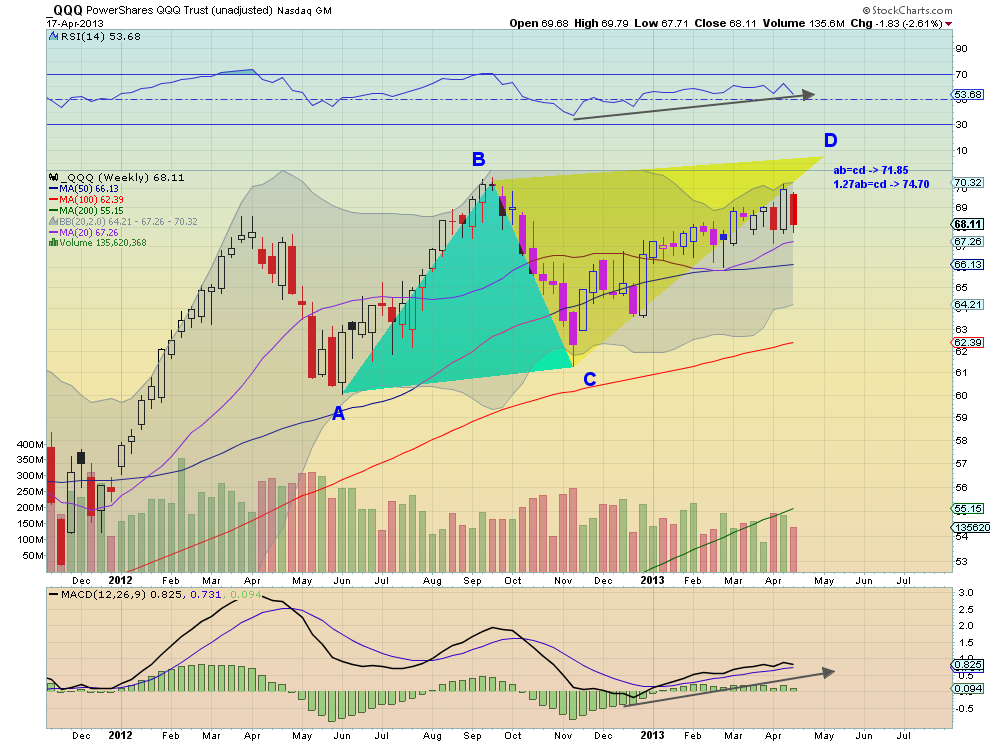

The weekly chart gives more reason to hold. The RSI is trending higher, the MACD is trending higher on the signal line and the price is trending higher-and-above the SMA’s. Additionally, it's working on an ABCD pattern that completes at 71.85 or 74.70 if it turns out to be a 1.27AB extension. I like the latter as it is also very close to the three-box reversal Point and Figure price objective of 76. If price does reverse and negate these signals, I'm out. But it's not time yet.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI