International Business Machines (NYSE:IBM)Information Technology - IT Services | Reports July 18, After Market Closes

Key Takeaways

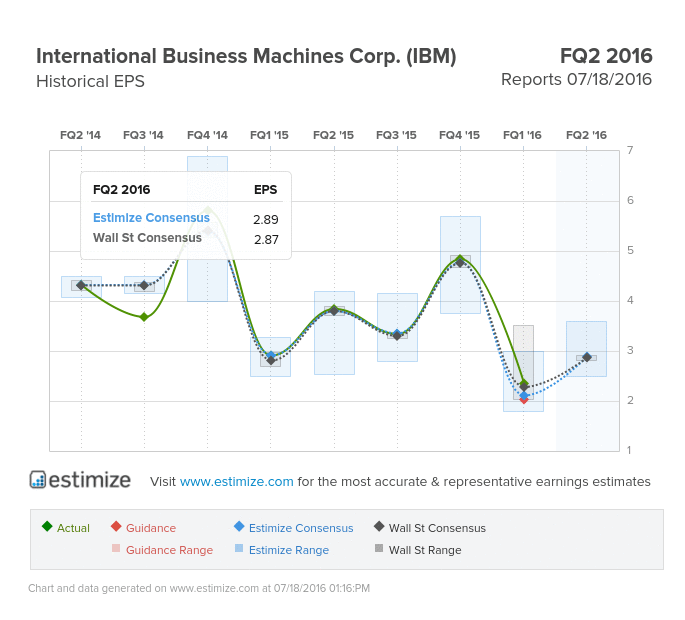

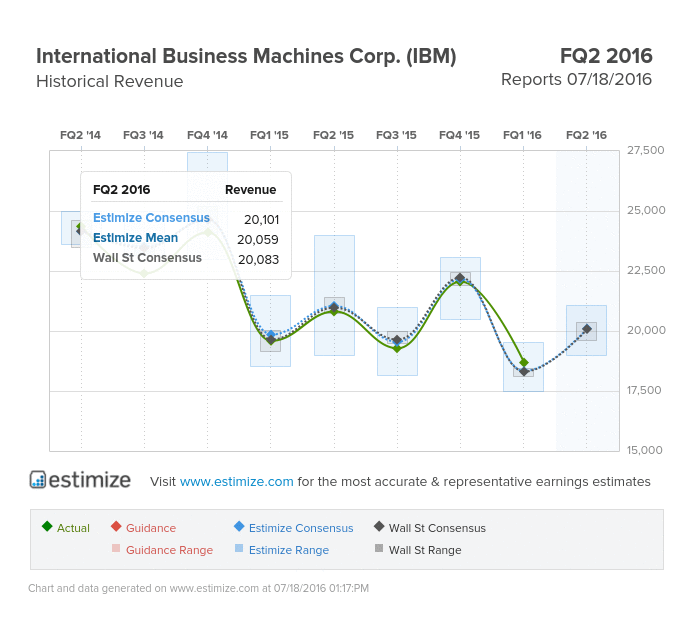

- The Estimize consensus is looking for earnings per share of $2.89 on $20.10 billion in revenue, 2 cents higher than Wall Street on the bottom line and right in line on the top

- IBM is investing heavily into building its cloud infrastructure as a means to transition away from its waning legacy business

- The surging dollar and Brexit vote could have a near term impact on earnings

This Monday, IBM is scheduled to report fiscal second quarter earnings after the market closes. The company has been under pressure lately to report both earnings and revenue growth. In the past 8 quarters, IBM has posted negative growth largely due to increased competition and a changing tech environment. Despite aggressively pursuing strategic acquisitions and partnerships, IBM is finding very little success. This quarter is already shaping up to be similar to previous quarters as IBM continues its downward trend.

The Estimize consensus is looking for earnings per share of $2.89 on $20.10 billion in revenue, 2 cents higher than Wall Street on the bottom line and right in line on the top. Compared to a year earlier this reflects a 24% decline in earnings and 4% drop in sales. Per share estimates have been cut 15% since IBM’s last report, reflecting analysts’ pessimism towards the company’s ability to turn a profit. The stock has largely followed its dwindling growth. In the past 12 months, shares are down 6% and typically fall 3% through an earnings report

Reenergizing growth has been IBM’s biggest problem in recent years. Its legacy business has been a large contributor to the company’s waning success. Weaker discretionary IT spending, and falling demand for software and legacy services have caused IBM to shift its focus to high growth markets. IBM is now aggressively expanding its cloud computing and analytics capabilities to maintain pace with the current tech environment.

Nonetheless, IBM is investing heavily in cloud computing, Big Data, mobile and security, and of course its cognitive system, Watson. In the short term, IBM must strategically position itself as a major player in cloud computing with Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT) and Google (NASDAQ:GOOGL). Recent partnerships with VMware Inc (NYSE:VMW) and Box Inc (NYSE:BOX) should help IBM streamline cloud growth.

Cloud computing was one of the lone bright spots in IBM’s Q1 earnings report. Cloud revenue increased 14% from a year earlier with cloud deliver as a service rising 42% over the same time. IBM also invested $3.6 billion in acquisitions and capital expenditures to expand its industry expertise in cognitive and cloud capabilities.

The relative strength of the dollar and Brexit vote should prove to be another roadblock moving forward. IBM has a large European footprint and will be one of the tech companies most impacted by the vote to leave. In 2016 they have already made two acquisitions in Europe as a means to boost revenue growth and improve its digital platform. While this might take a hit in the short term, IBM remains focused on bolstering its cloud business.

Do you think IBM can beat estimates?

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.