Cisco Systems, Inc. (NASDAQ:CSCO)

Information Technology - Communications Equipment | Reports May 18, After Market Closes

Key Takeaways

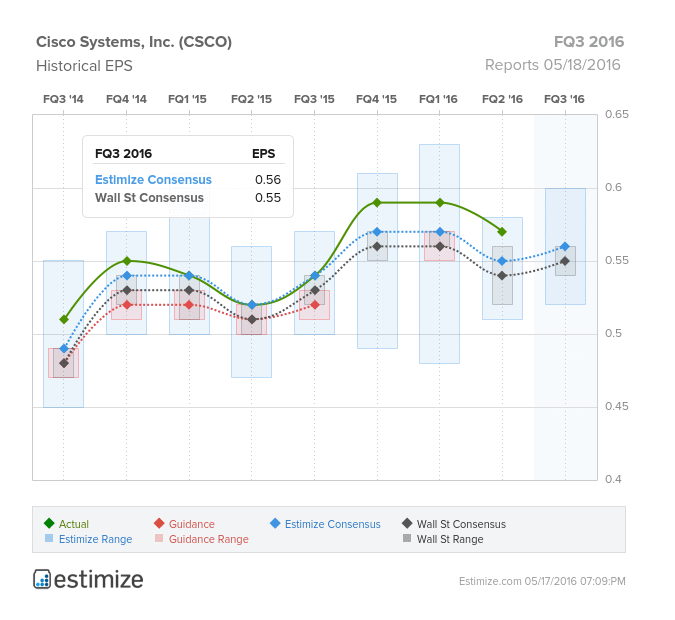

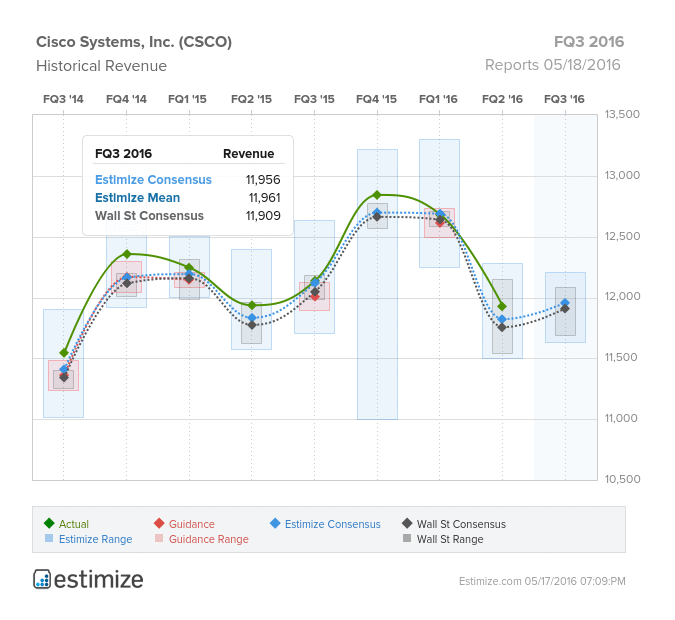

- The Estimize consensus on Cisco is looking for earnings of 56 cents per shares on $11.96 billion in revenue, 1 cent higher than Wall Street on the bottom line and $50 million on the top.

- Cisco has positioned itself towards high growth sectors such as cloud computing and cyber security in an effort to become a diversified provider of networking solutions

- Some risks to earnings include intensifying competition and the persisting slowdown in China.

Results for Cisco’s fiscal third quarter are scheduled to be announced this Wednesday, after the market closes. The networking giant is coming off a better than expected second quarter where it beat by 2 cents on the bottom and almost $100 million on the top. Despite macroeconomic uncertainty, Cisco saw an increase in all key financial metrics. Improving markets for its products on top of solid growth in areas like cloud computing and security should continue to boost earnings moving forward. The stock, on the other hand, has moved in the other direction, and is down over 10% from a year earlier.

In its Q2 analyst call, Cisco issued guidance of 1-4% revenue growth for the third quarter. This comes in slightly higher than the Estimize consensus which is expecting revenue to decline 1% to $11.96 billion. The same consensus is looking for earnings of 56 cents per share, reflecting a 4% gain from a year earlier. Unfortunately, the stock typically doesn’t move during earnings season, so investors don’t have a chance to reconcile their losses of the past 12 months.

Cisco’s transition towards high growth sectors such as cloud computing and cyber security are starting to pay off. The company has and will continue to use acquisitions to leverage more market share in these spaces. Moreover, as network spending improves, Cisco should benefit from a rapid rise in bandwidth consumption, high demand for data centers and increased adoption of its cloud networking.

Cisco saw weakness in its fast growing data center segment last quarter but expects that to be a temporary issue. Meanwhile, security has posted robust growth quarter after quarter. The second quarter featured double digit gains in revenue from security products. Cisco’s aim to become a diversified provider of all networking solutions should bode well moving forward

In the meantime, Cisco continues to see increased competition from smaller startups and established tech companies, including IBM (NYSE:IBM), Juniper Networks (NYSE:JNPR), Citrix (NASDAQ:CTXS) and even Amazon Web Services (NASDAQ:AMZN). China has also posed a problem for Cisco where it generates about $2 billion in revenue. Last quarter, the network giant saw orders in China decline nearly 20%, as a weakness in the region persists.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI