DSW Inc (NYSE:DSW)

Consumer Discretionary - Specialty Retail | Reports May 24, Before Market Opens

Key Takeaways

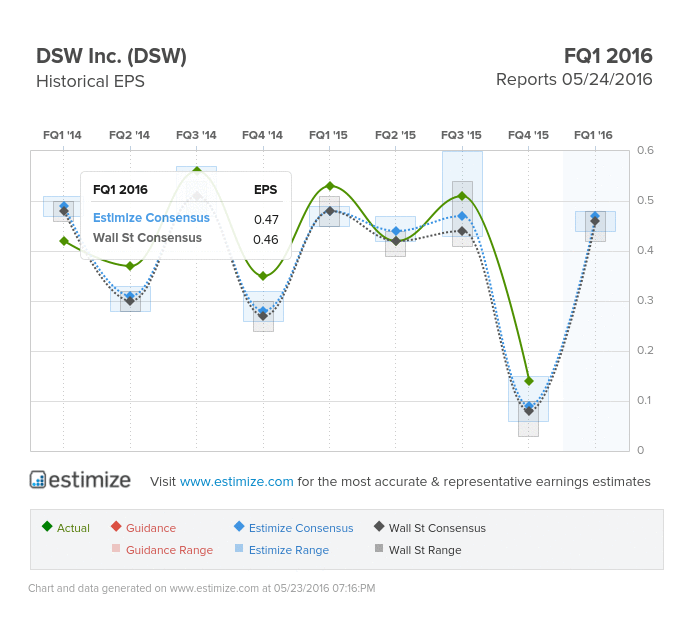

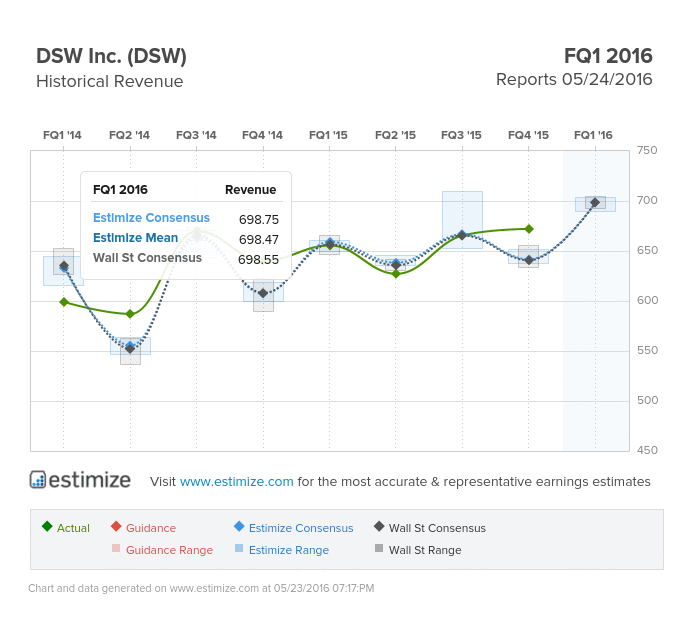

- The Estimize consensus is calling for earnings of 47 cents per share on $698.75 million in revenue, 1 cent higher than Wall Street on the bottom line and right in line on the top

- The company achieved several milestones in 2015 including opening 40 new domestic stores, a 22% increase in online sales and the acquisition of online shoe retailer Ebuys

- DSW has focused on expanding omni channel capabilities to maintain its position against Amazon (NASDAQ:AMZN)

This quarter retailers have taken a beating. Despite some wins in the past few days, the overall trend has been bleak. This should continue into the following weeks when the remaining companies report. This week we get results from discount shoe retailer, DSW which are expected to come in mixed. DSW capped off 2015 with a beat on both the top and bottom line. That said, earnings declined 60% while sales only grew by 5%. The stock, as a result, has reacted negatively and is down over 40% in the past 12 months. Similar results are expected for this quarter.

The Estimize consensus is calling for earnings of 47 cents per share on $698.75 million in revenue, 1 cent higher than Wall Street on the bottom line and right in line on the top. Compared to a year earlier earnings are predicted to decline 12% but sales could increase by 6%. On average, the company consistently beats expectations, trumping the Estimize consensus 75% of the time and Wall Street 81% of reported quarters.

Despite waning share prices, DSW fundamentals have been strong. Fourth quarter results featured a 5% increase in sales and nearly 1% gains in same store sales. The company also achieved several milestones in 2015 including opening 40 new domestic stores, 22% increase in online sales and the acquisition of online shoe retailer Ebuys. The acquisition is expected to bolster its position in ecommerce and off-price retail, two high growth areas in the retail sector. Early outlooks for fiscal 2016 predict that sales growth will continue to grow while pressure remains on margins and profits

Like most companies, DSW faces risks from Amazon’s growing position in the retail space. Besides Amazon, DSW competes with other big names like The Finish Line Inc (NASDAQ:FINL), Foot Locker (NYSE:FL), JC Penney Company Inc Holding (NYSE:JCP) and Macy’s Inc (NYSE:M). Meanwhile, direct to consumer initiatives from Nike (NYSE:NKE) draw traffic away from shoe stores, shifting them directly to the vendor’s website.

Do you think DSW can beat estimates?

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI