Recently, I asked what we should do for the rest of 2012.The most likely scenario is that US stocks will follow the election cycle and continue to grind upward, though in a highly choppy fashion.

While I still believe that equities will continue to grind upward, stocks appear to be a little extended in the short-run. My inner trader tells me to pull in my horns, raise a little cash and wait for a better entry level. This is strictly a tactical trading call with a time horizon of a week or so.

The chart of the SPX shows that the market has been exhibiting the bullish pattern of higher highs and high lows since early June. In the short-run, however, the market is now testing secondary resistance (dotted line) and faces further resistance at about 1% higher from current levels.

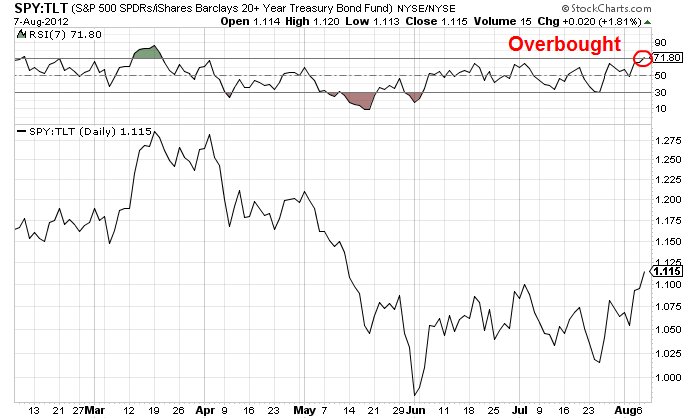

My short-term overbought/oversold indicator of the risk-on/risk-off trade shows the risk-on trade in overbought territory.

While an overbought market can get more overbought and there is further potential upside of 1% in the broader averages, the risk/reward ratio at this point is not tilted favorably for the bulls. I would rather wait for a better entry point if I had fresh cash and an aggressive trader may even wish to either lighten up positions or even possibly go short in anticipation of lower prices in the near future.

Remember - this is a trading call only. Know your risk tolerances and adjust your positions accordingly.

Disclosure and Disclaimer:

Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.