Trump slaps 30% tariffs on EU, Mexico

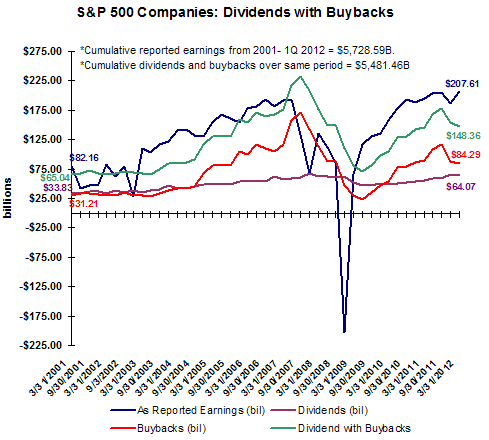

Both aggregate dividend payments and buybacks for companies in the S&P 500 Index declined in the first quarter of 2012. The decline in dividend payments is not unusual as first quarter payment amounts have been lower in Q1 versus the prior Q4 in ten out of the eleven first quarter periods since 2001. The pattern for buybacks is more mixed as aggregate buybacks have declined in six of the eleven first quarter reports since 2001. On a year over year basis, dividends are up 14.2% while buybacks actually declined 6.2%. S&P notes this decline in YOY buybacks is the first decline since the fourth quarter of 2009.

In a report from S&P on Tuesday, they note net dividend payments in the second quarter where higher by $12 billion, which S&P believes is a record dividend payout in aggregate dollars terms for U.S. domestic equities. Howard Silverblatt, Senior Index Analyst at S&P notes:

Payout rates, which historically average 52%, remained near their lows at 31%. At this point, we expect to see double-digit growth in actual dividend payments for the remainder of 2012, which would equate to a 16% gain over 2011.

Complicating dividend payment trends beyond this year is the impact expiring tax legislation will have on dividends at the end of 2012 that could increase the tax rate on dividends to over 43% versus the current 15% rate.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.