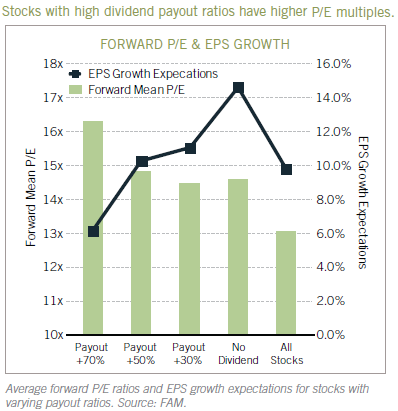

Essentially, the report indicates investors view high dividend payout equities as bond substitutes. The report states:

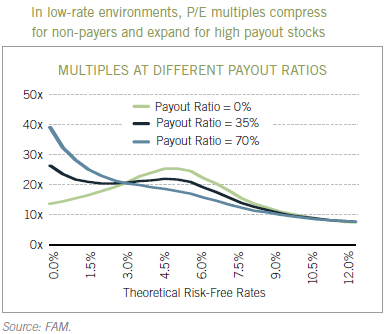

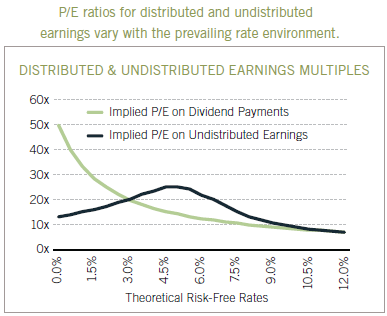

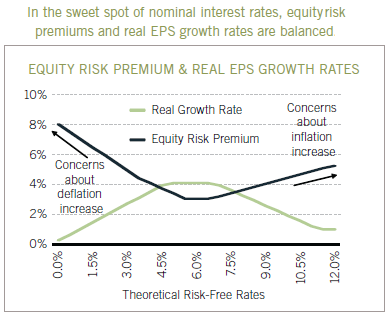

In a market with extraordinarily low nominal yields, the relationship supporting the risk premium between equity and fixed income is challenged, and stable high quality dividends can be viewed similarly to a bond coupon. Thus it would be logical for the market to value dividends within the prevailing yield structure of the fixed income market:

Price/Dividend = f (Interest Rates)

Undistributed earnings are still subject to economic uncertainties with investors expressing concern about a company's ability to effectively allocate capital. Consequently, we see a higher equity risk premium in the non dividend payers at low nominal rates.

The Fidelity report details the performance of of dividend payers in the Nikkei Index during the 2002-2012 time period. For Japan this period has been characterized by persistent deflationary pressures and the higher dividend payers have outperformed with lower volatility.

Investors need to keep in mind these higher yielding stocks are still equities. As such, equities are subject to the vagaries of the movements in the stock market.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.