Apple edges up premarket as investors weigh estimated tariff costs, iPhone sales

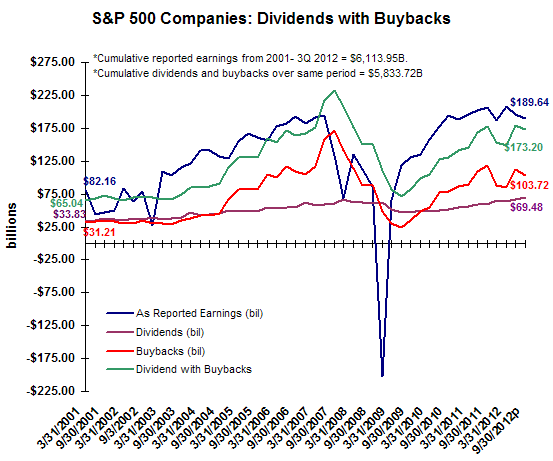

Late last week Standard and Poor's reported dividend and buyback data for S&P 500 companies through the third quarter of 2012. Year over year and quarter over quarter dividend growth was reported at 17.4% and 3.2% respectively. Buyback activity was actually lower on a year over year and quarter over quarter basis. YOY buybacks declined 12.4% and QOQ buybacks fell 7.2%.

Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices notes:

"Company buyback activity has been erratic over the past three months, given the continued uncertainty of the fiscal cliff and the potential impact on spending, companies may have taken a cautious approach to stock buybacks in the fourth quarter. In the background, however, is some talk of companies needing more shares to meet employee options, with more being exercised near year-end due to the anticipated tax change."

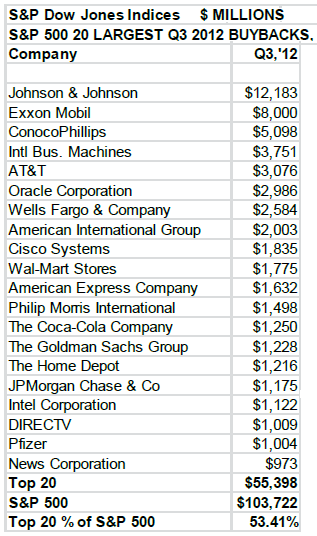

Silverblatt also notes the top heavy nature of the buyback activity. For the quarter the top 20 companies in the S&P 500 Index accounted for over 53% of the quarter's buybacks.