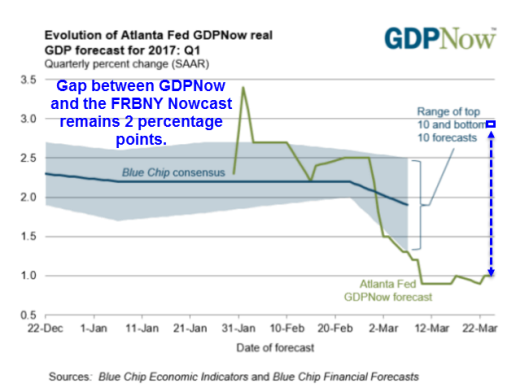

In the past week, the GDPNow Model declined by 0.2 percentage points. The Nowcast Model for first quarter GDP inched down by 0.1 percentage points.

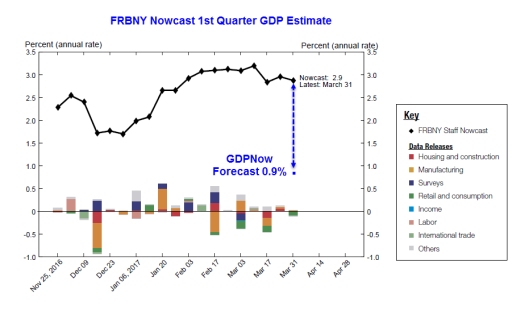

GdpNow sits at 0.9% and Nowcast at 2.9% so the Discrepancy widens by a tick to two percentage points.

GDPNow Latest Forecast: 0.9 percent — March 31, 2017

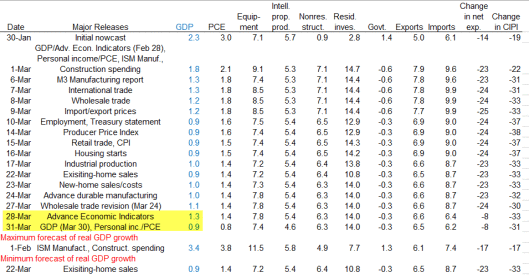

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2017 is 0.9 percent on March 31, down from 1.0 percent on March 24. After this morning’s personal income and outlays release from the U.S. Bureau of Economic Analysis, the forecast for first-quarter real consumer spending growth fell from 1.4 percent to 0.8 percent. The forecast of the contribution of net exports to first-quarter real GDP growth increased from -0.49 percentage points to -0.16 percentage points after Tuesday’s Advance Economic Indicators Report from the U.S. Census Bureau.

FRBNY Nowcast Latest Forecast: 2.9 percent — March 31, 2017

- The FRBNY Staff Nowcast stands at 2.9% for 2017:Q1 and 2.6% for 2017:Q2.

- Negative news from consumption data reduced the nowcast by about one-tenth of a percentage point for both quarters.

Consumer Spending Disaster

I expected today’s personal income and outlays report would change the forecast by about half a percentage point to the downside. It was a disaster.

Instead, GDPNow and Nowcast both declined a mere 0.1 percentage points. Why?

The following table from GDPNow helps explain.

In between reports, the effect of the advance economic indicators was +0.2 percentage points. Thus the personal income and outlays report did have a sizable impact.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.