Stock market today: S&P 500 closes lower, but posts second weekly win

Yesterday's figures saw the USD Index topple for its worst day in 3 weeks, resulting in the EUR/USD recouping losses and the Cable briefly breaking to 2.5 year highs.

Core Retail sales came in at 0% versus the 1% expected, making it the lowest reading in 7 months. Since 2009 this is only the 5th occasion it has come in at 0%.

Retail sales came in at -0.4%. With an expectation of 0% and coming in at its lowest in 10 months, it does not bode well for consumer spending.

Unemployment claims, while coming in less than expected, has been declining steadily since 2009. Though not as low as pre-crisis levels in 2007, we did see similar levels of unemployment claims around 2004-2005.

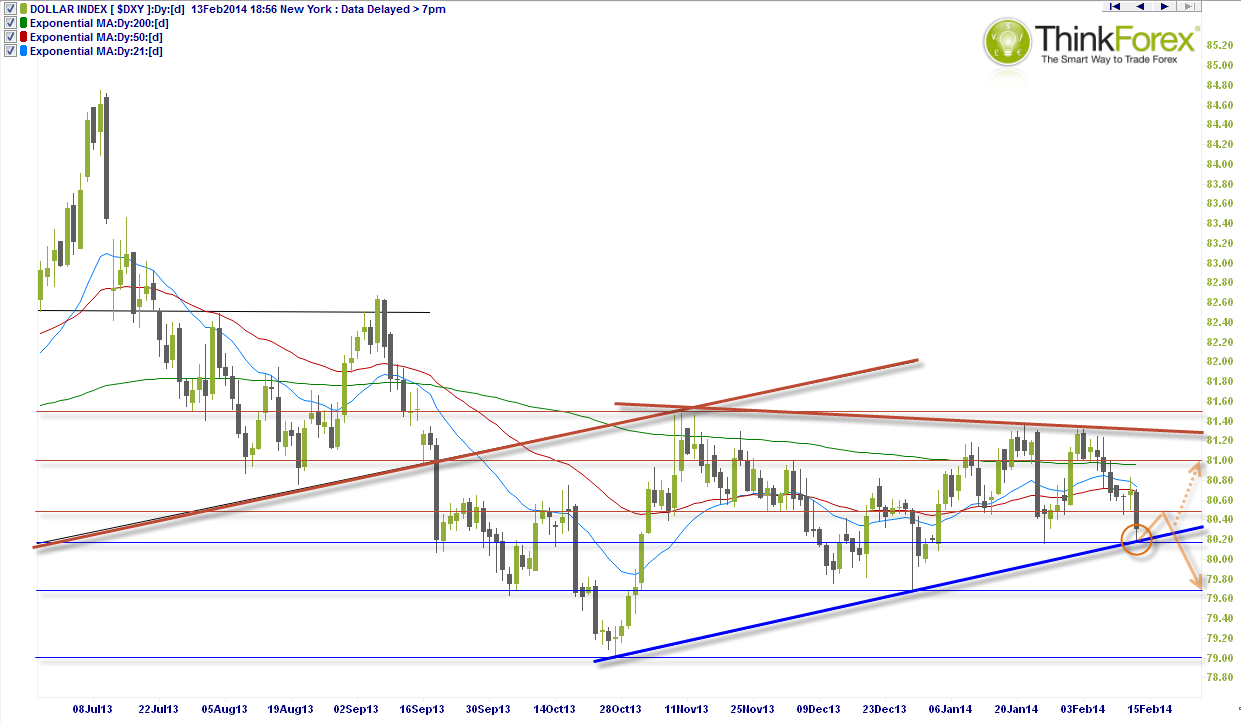

USD INDEX: Daily

With an intraday low of 80.20 testing the lower rising trendline, which is also a horizontal level of support. Closing the day higher my bias is for an initial retracement to 80.50, only a break above here would entice a further recycling within the triangle formation and target 81.00.

A break below 80.20 would be a good victory for the bears and target 79.70. A weekly close around current levels would increase the odds of a topping formation forming with the Jan and Feb tops forming a Double Top formation to target the 79.00 lows.

DISCLAIMER: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market. If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade.

A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au .The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.