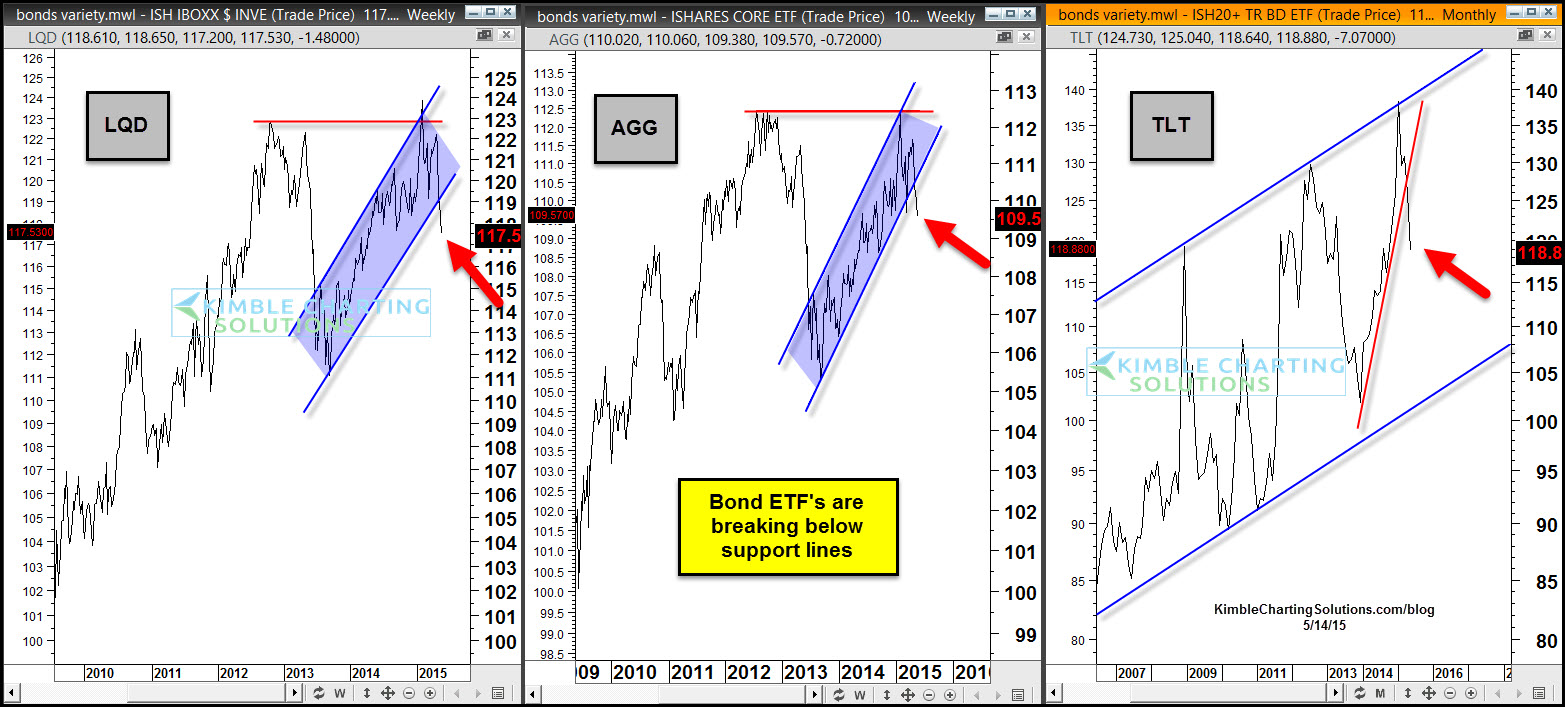

Did key bond ETF’s create long-term double tops over the past couple of years? The above 3-pack takes a look at three different bond ETF’s. (ARCA:AGG) and (ARCA:LQD) earlier this year attempted to break above 2012 highs. At this time it looks like they failed and may have created double tops. As the potential double top was forming, (ARCA:TLT) was hitting the top of its multi-year rising channel.

What do all three have in common? Recently each is breaking below support dating back to 2013 lows.

What might be causing this weakness in bonds?

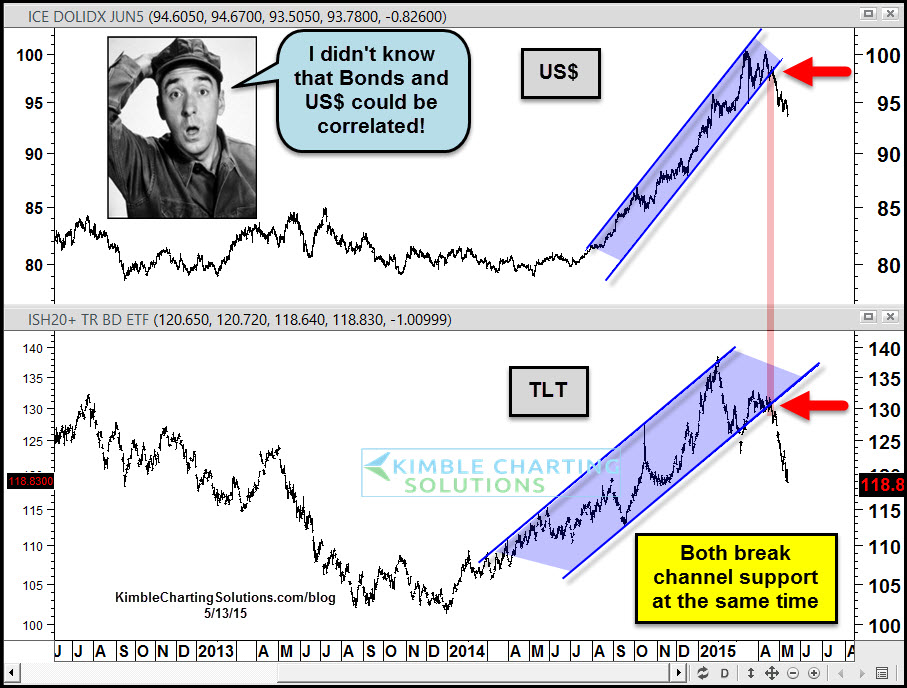

Any chance the US dollar has something to do with this?

(ARCA:TLT) and the U.S. dollar both had fantastic rallies last year, forming steep rising channels. Speaking again of “double tops,” did the US$ also put in a double top earlier this year?

As you can see TLT and the US$ both broke support of the steep rising channels at the same time in the chart above.

Regardless of the perceived reason as to why this is happening, bond prices across the board and the US dollar are breaking support. A few times in history this has happened, Commodities have caught a bid and moved higher. Will it be different this time?

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.