Trump says he will sue Wall Street Journal, NewsCorp, over Epstein letter report

So I hear that Warren Buffett took another tubby and decided that Municipal Bonds were no longer a good thing to own. First questions: Was Meredith Whitney in the tub with him? Second: Dude what are you thinking? Giving him the benefit of the doubt and since he is a longer term investor let’s start with a look at the weekly chart to see what is out there.

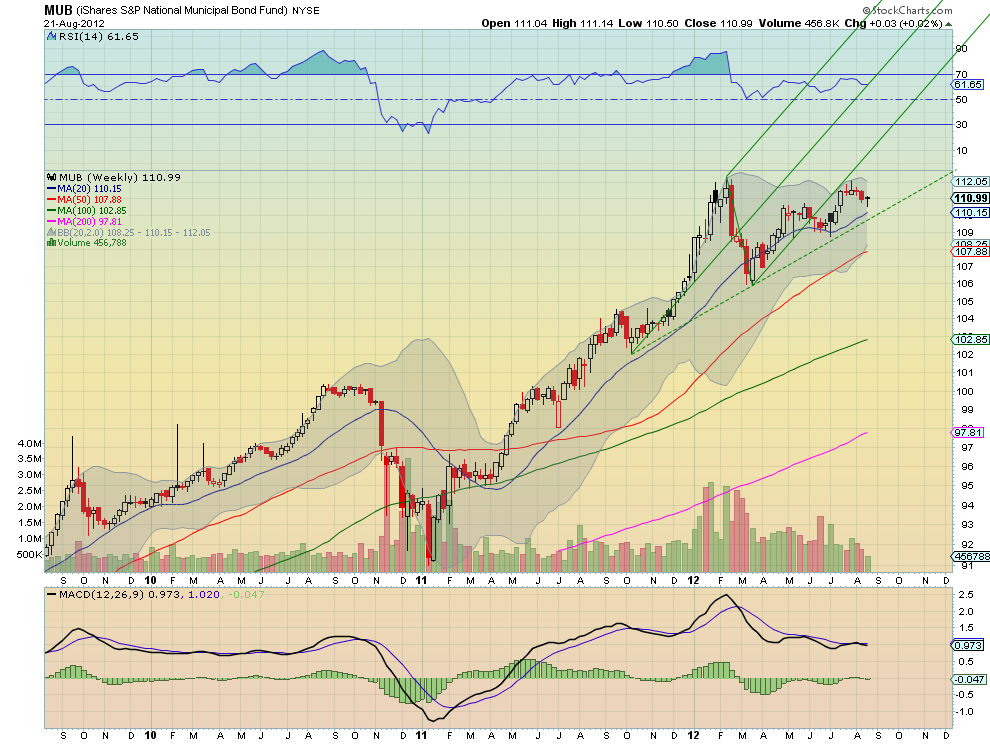

The Andrew’s Pitchfork shows a break of the Lower Median Line followed by a retest and now a move back lower. Still over the Hagopian trigger line, which would indicate a bear move lower, but with the Relative Strength Index (RSI) bullish and Moving Average Convergence Divergence indicator (MACD) running flat, there is cause for caution but not a time to short yet.

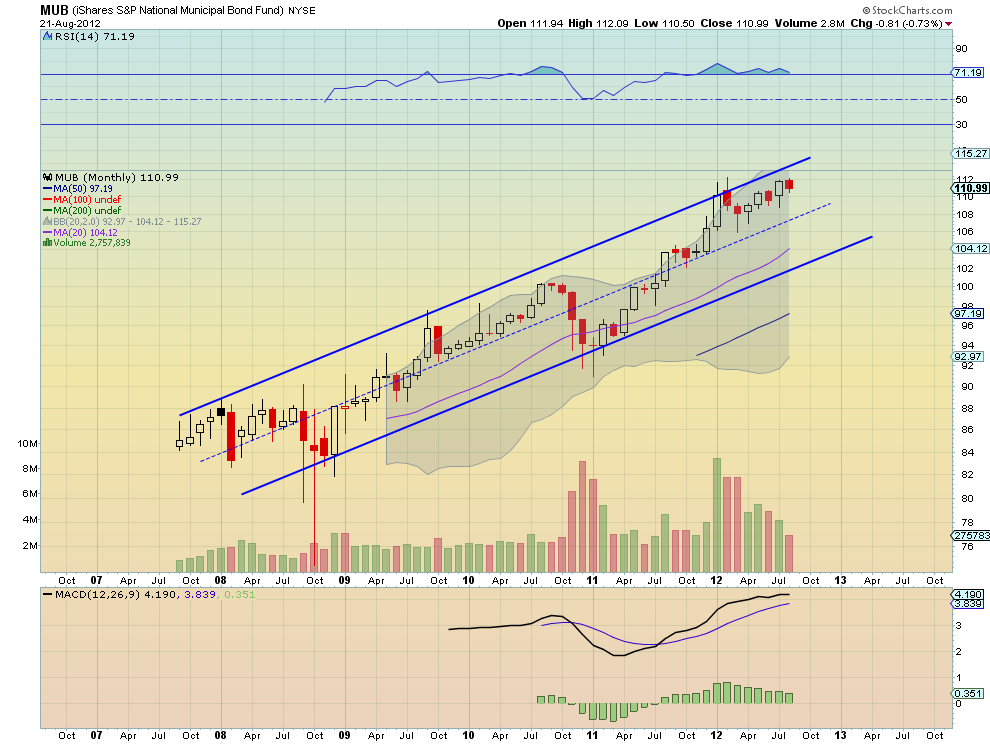

That foxy old man looks prudent on this time frame. But he has a very long view. Maybe we should glance at the monthly chart as well. The rising channel dominates this chart. There are some signs of a topping action with the RSI flattening in technically overbought territory, with declining volume and a MACD that is fading. But the trend remains higher. For a long-term investor like Mr. Buffett you would expect a break of the channel lower before dumping them. Maybe he is just early or maybe he got a tip in the tub.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI